Richard Thalheimer remembers the last time inflation was so challenging for American retailers: it was in the late 1970s and 1980s when he was trying to get The Sharper Image off the ground.

In 2006, he left the consumer electronics chain he founded, selling his shares before going bankrupt in 2008. Since then, he has invested the proceeds from his sales of watches, massage chairs, iPods and Razor scooters, building a portfolio worth up to $350 million that includes stocks like Amazon, RH and Home Depot.

“It’s so funny,” he said. “Until this year”.

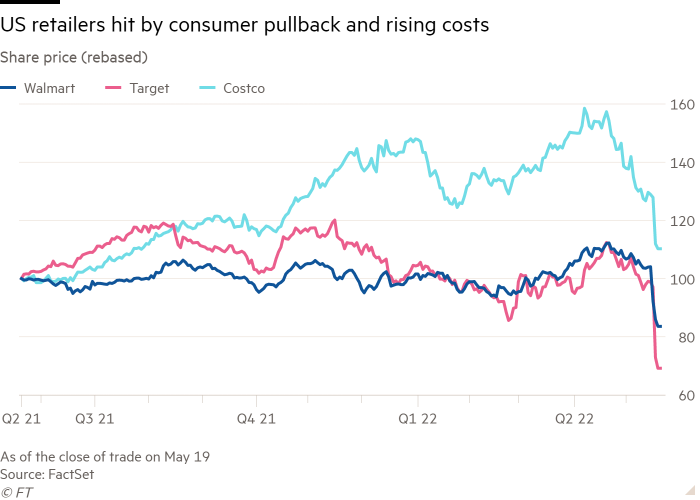

as inflation The retail industry that made Thalheimer rich in its last rivalry 40 years ago is now making other investors poorer and raising fears of a recession.This week, unexpectedly bad earnings announcements came from walmart and Targetare its two largest constituents, leading to the stock market’s biggest drop since Black Monday in 1987.

A few days ago, analysts had been touting the companies as defensive shelters amid a storm of tech stocks, which have slashed the valuations of companies from Amazon to Netflix. Earlier this week, Baird named Walmart the top idea for the “recession playbook.”

But the shockwaves from Walmart and Target rippled through the wider retail sector, bringing new concerns to the market: Inflation may already be biting consumers now, even before the Fed started raising rates more aggressively.

Retailers are the biggest driver The broader market fell sharply On Wednesday, the S&P 500 posted its biggest one-day drop in nearly two years.

Until this week, the S&P 500’s consumer staples sub-index, which includes “big” retailers such as Walmart and businesses such as pharmacies and food makers, has remained largely unchanged for the year. The only other components of the index that avoided losses were energy and utilities stocks, which benefited from a surge in energy prices.

However, the sub-index had fallen nearly 9% as of Thursday’s close, on track for its worst week since the start of the coronavirus pandemic in March 2020.

Not only is the retailer’s earnings worrisome, but it raises three concerns: Higher prices could Reach the limit What will consumers tolerate, retailers are struggling to control their costs, unpredictable demand and new supply disruptions are forcing them to stock up.

The first of the three has received the most scrutiny for its broader economic impact. “Your consumers are starting to back off,” said Steve Rogers, director of Deloitte’s Center for Consumer Industries, whose survey showed that 81 percent of Americans are concerned about rising prices.

Americans’ bank accounts may not have changed much since last year, but headlines about inflation have shaken their confidence, he said. He added that some people were cutting prices or delaying bulk purchases as a result, especially in non-essential categories such as clothing, personal care and household items.

Walmart, long seen as the U.S. consumer bellwether, noted that high inflation in food prices “saves more dollars from [general merchandise] Exceeded our expectations as customers had to pay for higher food prices.”

However, Rogers and others argue that retailers’ own cost pressures are the more obvious driver of their changing fortunes than the pullback of consumers. At Walmart, for example, fuel costs in the U.S. were more than $160 million higher than expected last quarter — more than it could pass on to customers.

“We didn’t expect shipping and freight costs to skyrocket like they are now,” echoed Target CEO Brian Cornell. Higher wages and costs for containers and warehouses are also weighing on retailers’ profit margins.

Some of those higher costs stem from a third force: disruptions to global supply chains, causing retailers to scramble to secure inventory at a time of uncertainty about demand. “Their inventory is exploding,” Cathie Wood, chief investment officer at Ark Invest, wrote in an article. twitter post Walmart and Target.

Rogers said the reason for more inventory than usual is “they’ve been through the last two years of being out of stock and know how much it’s costing them”.

Walmart CEO Doug McMillon said some of the hoarding was intentional, saying, “We like the fact that our inventory has increased because of the need for a lot of inventory.” However, he acknowledged, “32% of the The increase exceeded our expectations.”

Target’s inventory increased further, up 43% from a year ago, and it admitted it failed to foresee a shift in consumer spending from TVs to toys.

“We’re definitely not where we want to be right now,” said Target Chief Operating Officer John Mulligan, adding that “slowness in the supply chain” is forcing it to carry more inventory just in case.

Wayne Wicker, chief investment officer at pension plan manager MissionSquare Retirement, said it wasn’t surprising to see signs of consumers taking control of some of their spending, but said this week’s results were a big surprise for some investors. Saying that is still a “wake-up call” as many companies have only recently claimed that they have handled the inflation challenge well.

Both Walmart and Target have provided upbeat forecasts in previous quarterly updates and have not pre-announced any changes ahead of this week’s reports.

“Part of the reason for the price drop is that the management of these big companies has not provided any indication that they are going to make such a blunder,” Wick said.

Denise Chisholm, head of quantitative strategy at Fidelity, believes this week’s reports do not provide convincing evidence that the economy is struggling, but they spook already nervous investments after the earlier sell-off By.

For example, despite the market’s visceral reaction to Target’s results, its new lower forecast will only restore margins to pre-pandemic levels.

“If with [previous bear markets]it’s always been a force for earnings, so in the short-term, any concern about earnings would bring more volatility,” Chisholm said. But, she added, “while there’s a lot of concern in the market, it’s hard to draw a conclusion. An empirical conclusion that a recession is more likely given what we’ve seen.”

Thalheimer, whose portfolio is down about $50 million from its peak, believes the market has overreacted this week and is already thinking about when to consider snapping up battered retail stocks.

“During most of the big sell-offs in my life — 2009, [bust following the] The dot-com bubble or 1987 – it was you almost every time for two years [saw] A very strong recovery,” he said.

He believes that will happen again, but with a combination of uncertainties in supply chains, the war in Ukraine and historic inflation, “there will be some choppy waters ahead”.