As an early adopter of cryptocurrencies, DJ and producer Justin “3LAU” Blau immediately drew the line between blockchain technology and the music industry.

In 2018, he launched a blockchain-powered music festival where participants earn collectible assets by scanning QR codes. In 2021, he marked the third anniversary of the release of his album Ultraviolet by auctioning off 33 NFTs related to songs on the album, physical vinyl and unreleased music – all of which fetched $11.6 million in just 24 hours income.

“All the people who are spending money on these things believe the narrative I’ve been pushing for years,” Blau said. “I feel an innate responsibility to see this technology develop into what I want it to be.”

So last year, Blau co-founded Royal with entrepreneur JD Ross, a marketplace where artists can sell their music royalties to fans as NFTs, or, as Blau prefers to call them, “limited digital assets.”

“We’ve never used the term NFT since day one,” Royal CEO Blau said. “This sentence carries all that baggage. In creating Royal, the goal has always been to give people access to one asset class: music.”

With Royal, artists sell fractional ownership of their royalties along with perks of their choice, such as real-life experiences and merchandise, priority for future drops, access to unreleased music, and more. Royal is still in beta, but has included major artists including Nas, Big Boi, Diplo and The Chainsmokers on its roster.

many in cryptocurrencies touted The music industry is the next wave after art, pushing NFTs into the mainstream. Besides Royal, there are NFT-native startups like Catalog and Opulous. Royalty Exchange, one of the leading platforms for investing in song royalties, merged with NFTs last year. Even more traditional music companies, such as major labels Universal Music Group and Sony Music, as well as streaming giant Spotify, are dabbling in Web3.

But for Blau, Royal isn’t competing with many others in the market. Given his own background as an artist, early crypto champions, and Royal’s fan-centric approach, Blau believes Royal is uniquely positioned to lead everyday fans to invest in the people and art they love.

“On average, people don’t really understand what stocks do. But they do understand what they like and what their friends like,” Blau said. “The cultural investment is very interesting in itself. It’s especially interesting that music is the wedge to that. Our job at Royal is to make that easy for everyone to understand.”

royal beginnings

Blau, 31, is a full-scholarship student in finance at Washington University in St. Louis, intent on getting into investment banking. But while on vacation in Sweden in 2011, he discovered electronic dance music (EDM). He started making mashups of songs he would post online, which went viral. By the end of Blau’s junior year, a recruiter at investment management giant BlackRock offered him an internship that would give him a quick break into Wall Street. Blau chose to dive headfirst into music, but his financial background didn’t necessarily go to waste.

In 2014, Blau was DJing in Mexico when he met Cameron and Tyler Winklevoss. At the time, they were preparing to launch their cryptocurrency exchange Gemini, and Blau saw the possibilities of bitcoin and blockchain without much convincing. Blau made a passive investment in Bitcoin, which soon gave way to his own crypto-music project. As NFTs go mainstream in 2020, he sees an opportunity to attach music IP rights to NFTs. Initially, he considered serving on the board of a company in this space. But Blau’s friend, Fred Ehrsam, co-founder of major cryptocurrency exchange Coinbase and investment firm Paradigm, challenged him.

“He said, ‘If someone else came up with the idea and not you, if it worked out, would you regret it 10 years later?'” Blau recalls. “That’s what convinced me.”

” . . . it’s important for the artist to stand up and approach the space in a different way”

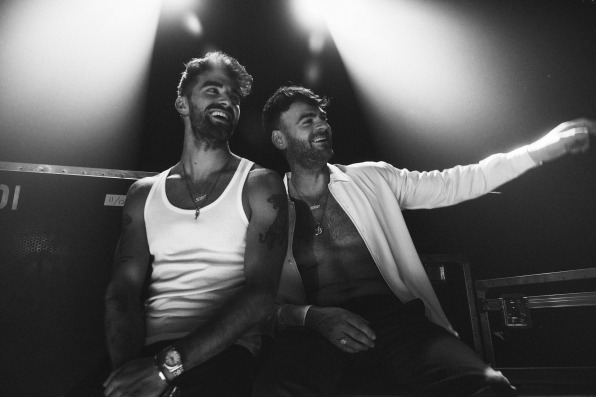

Launched in May last year, Royal raised $55 million in a Series A round led by a16z, in addition to funding from Creative Artists Agency, Coinbase Ventures, and companies including Kygo, Logic, Nas, and The Chainsmokers (Drew Taggart and Alex Pall) Additional investment for artists included.

“It’s about supporting two amazing people [Blau and cofounder JD Ross] They really understand the intricacies of the space,” Pall said, “and have a lot of operational experience to build something that is capable of a business that is often considered outdated. “

In conjunction with the release of the latest album, So far, so good, The Chainsmokers are giving away 5,000 limited digital assets to their most loyal fans on Royal. In addition to exclusive content and other benefits, owners of these LDAs will also receive 1% of album streaming royalties. If fans sell their LDA on the secondary market, the proceeds will be distributed among the album’s 14 songwriters, excluding The Chainsmokers himself.

“I think Web3 is getting a lot of negative publicity with these quick, money-grabbing token drops and junk coins,” Pall said. “It’s important for artists to come forward and approach this space differently.”

As Taggart mentioned, The Chainsmokers ditched Royal in order to make their fan base deeper, not wider.

“We put out a lot of music and we’re lucky to be successful globally. But when something like this happens, you can lose touch with your fan base,” he said. “We really wanted to find a way to reconnect with them. I feel like, sound-wise, we did that on this album.”

Royal gave them an extra chance to connect. “We found a way to musically double down on what our thesis is with this technology, and this is how do we make our fans what they have?” Taggart said. “We can also see how they interact and build more of what we can offer to these token holders. It feels really symbiotic.”

” . . . if you can’t lose $150, don’t buy this”

The Chainsmokers aren’t using their price cut as a money-making opportunity, but singer-songwriter Vérité has tapped the Royal’s earning potential, which is especially important for a smaller artist.

Vérité has long been a proponent of Web3 technology, and if for no other reason, it offers a different avenue for expanding her audience.

“I just see the trend turning, if you want to be successful [in the music industry], you have to be famous on TikTok,” she said. “I don’t dance on TikTok. I don’t have the personality to do such a thing. “

Vérité actually tried her own NFT drop last April, which she now describes as “a very clumsy experiment.”

Vérité auctioned off part of the streaming royalties of her song “By Now,” valuing it at $1 million. She sold 2.3% for about $23,000, but realized that the price points for these NFTs, ranging from $1,800 to $20,000, were too high for most of her fans. Around the same time, Blau got Royal off the ground, and the market’s approach to decentralized ownership was exactly what Vérité was looking for.

She was able to split her royalties into more affordable tokens, starting at $145. Her Royal launch of “By Now” raised about $90,000.

“The strength of all this is that the artist can set his own valuation,” said Vérité, the second artist at Royal after Nas. “Fans and collectors can get involved at any level they want.”

That said, Vérité is clear to her audience that participating in her delivery is more about being a patron than an investment opportunity. Her latest song, “He’s Not You,” offers LDA three tiers: 0.0520% ownership for $145; 0.2262% for $400; and 0.8580% for $950. Because Vérité is independent and has her own guru, she does get a larger portion of her streaming revenue. So, in theory, those who buy the tokens could receive a sizable amount of change if her song goes mainstream.

But as Vérité himself admits, that’s unlikely. “I had a town hall on Discord and I was like, ‘If you can’t lose $150, don’t buy this,'” she said.

Vérité sees Royal as a tool to cater to her specific fan base who are willing to pay in addition to streaming her music and watching her shows. Even though this may be a niche group for any artist, she sees tremendous value in connecting with her audience on a deeper level.

“Let’s be real, paying extra for art is a luxury,” Vérité said. “Most people are focused on paying their bills, which is why it’s so important that the baseline is free. For me, art is free. So what can I do for people who can pay? How can I Create an experience for them?”

In turn, artists—especially smaller independent artists—have new revenue streams. In Vérité’s case, she was able to fund her next album because she gave up Royal. “In general, getting funding is inherently predatory. This is especially egregious in the music industry,” she said. “I’ve always advocated for artists to channel their own initial capital so that when they talk to labels, publishers, etc., they can negotiate from positions of power and influence.”

Invest in the future

No one would say it’s a bad thing for independent artists to have another resource to fund their art and live a sustainable life. But are there some successful examples that show Royal or something like that will be a viable avenue for artists in the long run?

Music catalog consultant Alaister Moughan can see the potential of NFTs in the music industry, especially as they relate to attracting fan bases through exclusive perks. However, he suspended the idea of NFT-based music investments. “Sometimes you wonder, is there a market for something like an artist or a piece of work, is that something people aspire to?” Mohan said. “Or, in theory you’d be open to an interesting idea, but you realized no one actually asked for it?”

Echoing Vérité’s sentiments, Blau spoke candidly to fans about the feasibility of earning significant income from decentralized ownership. That said, in the near future, he hopes to show fans historical streaming data so they can better understand possible spending.

“We don’t pretend to know how the future will behave. However, we can make the past transparent,” Blau said. “It’s something that a lot of people in the crypto space don’t do well. It’s very important to represent what people are actually buying.”

Currently, Royal’s marketplace is a select artist, but Blau wants to be open to any artist, any genre.

“If we support this technology as the future of music culture, we have to rely on it,” he said. “Frankly, we can’t just issue a bunch of male white DJ tokens every week. It doesn’t represent culture.”