this general narrative of markets and economies It has been one of those situations where demand is strong but supply is lagging, a dynamic that leads to Inflation soars.

While most signs point to these trends continuing, a few anecdotes from the past week suggest that may be changing.

Signs that stocks are no longer running out

Supply chain disruptions are reflected in Inventory/sales ratio declines. In fact, many businesses have been complaining about stronger sales If only they could keep the shelves stocked.

according to a Census Bureau A report on Tuesday showed that business inventories rose 2.0% in March from the previous month. The inventory/sales ratio edged up to 1.27, but remains low relative to historical levels.

However, during last week’s earnings call, the retail giant walmart and Target Suggest that this issue may be a thing of the past for them.

“We like the fact that our inventory has increased because we need to have a lot of inventory at our counters, but the increase of 32% is higher than we would like. Over the next few quarters, we will address most or all of the excess inventory .” – Walmart CEO Doug McMillan“While we expect these categories to slow post-stimulus, and we expect consumers to continue to shift their spending focus away from goods and services, we do not anticipate the magnitude of this shift. As I mentioned earlier, this Caused us to overstock, especially in the big-ticket categories, including kitchen appliances, TVs and outdoor furniture.”- Brian Cornell, CEO of Target

this striking chart Bloomberg’s Kriti Gupta illustrates the aggressiveness of some big retailers in increasing their inventory.

This phenomenon of enterprises from undersupply to oversupply is called “bullwhip effect. “Joe Wesenthal, Bloomberg explain:

“Demand surged. Companies aggressively ordered and even overbooked to make sure they had inventory. Then demand changed. Suddenly, fears of shortages and empty shelves turned into stockpiling, oversupply and deflation.“

There are two very important things to note about the situation with these retailers.

First, they are influenced by the fact that Consumers spend less on tangible things and more on intangible experiences. In fact, United Airlines comfirmed on monday Revised summer travel outlook.

Second, this has nothing to do with any unexpected weakness in consumer spending. In fact, both Walmart and Target reported better-than-expected comparable-store sales growth.The Census Bureau’s latest monthly retail sales report confirms strong consumer strength across the economy New record set in April.

“[Customers’] Spending power continues to benefit from increase savings rate, high employment rateand healthy wage growth,” Target’s Cornell says.

Signs that delivery times are improving

As commodity demand rebounds, Delivery orders are taking longer and longer.

However, these lead times seem to be getting shorter and shorter.

According to a manufacturing survey New York Fed and Philadelphia Fedsuppliers’ delivery time index fell to its lowest level in months in May.

However, both surveys also indicated that manufacturing activity in the mid-Atlantic was weakening. As such, these shorter lead times are likely more due to slower demand than supply chain improvements.

Signs the labor shortage is fading

Walmart, America’s largest private employer, echoes what Amazon, America’s second largest private employer, recently said1:

“As the number of omicron variant cases declined rapidly in the first half of the quarter, more employees furloughed due to COVID returned to work faster than we expected. We hired more staff at the end of last year to serve those furloughed service, so we ended up with weeks of overcrowding.” – Walmart CEO Doug McMillan“With the Omicron variant emerging in late 2021, we saw a significant increase in furloughed employees in the fulfillment network, and we will continue to hire new employees to cover these absences. As the variant subsided in the second half of the quarter and employee furloughs returned, we There was a rapid transition from understaffing to overstaffing, resulting in a drop in productivity.” Amazon CFO Brian Olsavsky

The statements are very similar, although they reflect a phenomenon unique to the big-box retail industry.

At the same time, however, rumors have also picked up Hiring freezes and layoffs in tech.2 On Tuesday, The Hollywood Reporter first report Netflix will lay off 150 employees.

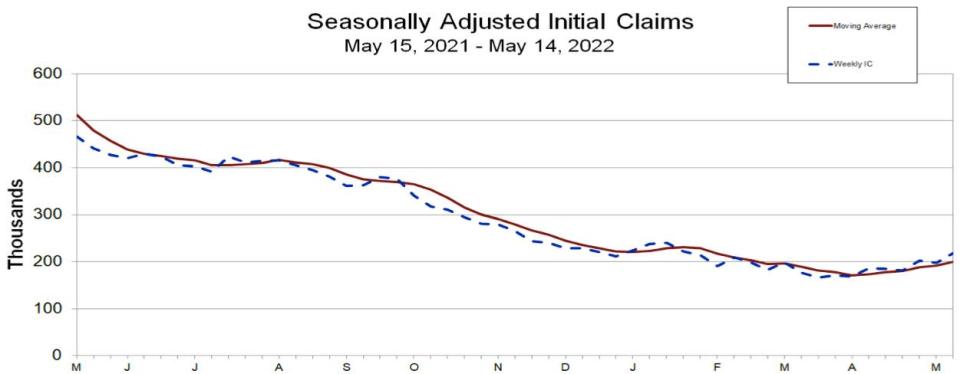

One of the most popular ways to track the health of the labor market is statistical Initial Claim for Unemployment Insurance Benefits, reported weekly. While claims levels remain near 50-year lows, they have risen slightly in recent weeks.

Initial jobless claims rose to 218,000 in the week ended May 14, up 21,000 from the previous week. This is the highest level since January.

What this means for inflation

With supply chain disruptions lasting longer than many expected, the resulting shortages have led to much higher inflation than many expected.

So the Fed’s response is tighten monetary policy. They argue that tighter financial conditions should cool the labor market, which in turn cools wage growth, which in turn cools demand to levels more in line with supply. This should eventually cool inflation.

Bloated inventories and shorter lead times suggest that supply chains are no longer an issue. Hiring freezes and layoffs suggest wage growth should cool. Assuming these anecdotes turn into economic trends, inflation should drop soon.

zoom out

Again, last week’s headlines were anecdotal, with little movement in economic data.

Then again, most megatrends start with small changes in anecdotes and data.

as economic story unfold, we’ll keep a close eye on layoffs, initial claims, in stock, Supplier delivery time, Order backlogand of course various ways of reporting inflation.

More from TKer:

rear view 🪞

📉🐻 Stocks continue to fall: The S&P 500 fell 3.0% last week, its seventh straight weekly decline. The index is now down 18.7% from its Jan. 3 closing high of 4796.56. The S&P also hit a session low of 3,810.32 on Friday, 20.9% below its Jan. 4 session high of 4,818.62. For more information on market volatility, read this and this. If you want to understand the bear market, read this.

🦅 Powell is a hawk: Federal Reserve Chairman Jerome Powell warns central bank efforts cool down inflation It could be a bumpy ride for the economy. “Returning to price stability may bring some pain,” he said said Tuesday at a Wall Street Journal event.

🇺🇸 Record-breaking economic data: Retail sales climbed to a new record in April. Industrial production activity also rose to a record high in April. For more information on these reports, please read this.

🛍 A taste of retail revenue: As mentioned above, walmart and Target Both reported solid sales growth. However, both companies are struggling with rising costs, and their earnings have been disappointing as a result. Walmart shares plunged 11.3% on the news. Target shares plunged 24.9%.

📈 Mortgage rates fall from highs: The average rate on a 30-year fixed-rate mortgage fell to 5.25% from 5.30% the previous week, according to data Freddie Mac.

🏘 house sales slip: Existing home sales fell 2.4% to an annual rate of 5.6 million units in April National Association of Realtors (NAR)“Rising home prices and sharply higher mortgage rates have reduced buyer activity,” said NAR Chief Economist Lawrence Yun. “It looks like more declines are on the horizon in the coming months, and after the significant spikes over the past two years, we may be Will return to pre-pandemic home sales activity.”

Hit the road 🛣

It’s all about inflation these days. So all eyes will be on Friday’s release of the core PCE price index, the Fed’s preferred inflation gauge. Economists estimate the measure rose 0.3% in April from the previous month and 4.9% from the previous year.

The April durable goods orders report will be released on Wednesday.Orders related to business investment are at Record levels in March. Will the April report be just as strong?

1. These rankings come from Fortune 500 list.

2. layoffs.fyi Have been tracking layoffs at many of these tech and startups.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance Twitter, Facebook, Instagram, flip, LinkedInand YouTube