Some questions I’m thinking about right now:

1. Does inflation provide us with a great buying opportunity? Back when inflation was still below 2%, I asked if Inflation could give us a great stock buying opportunity.

The price increase was higher and lasted much longer than I assumed at the time, but it’s worth revisiting the issue given the bear market in the stock market.

Many believe that we may be heading back to the 1970s, when inflation remained high for years. It’s possible, but let’s see what has happened since the Fed explicitly told us they would fight price increases:

- Interest rates are rising.

- Mortgage rates have essentially doubled from their lows.

- All the speculative stuff like IPOs, SPACs and cryptocurrencies collapsed.

- Companies that don’t make money are punished.

- The Fed is raising interest rates.

- The government shut down the fiscal spigot.

Remember, the Fed eased monetary policy in the early 1970s. Paul Walker It didn’t take over until 1979, eventually raising interest rates to astronomical levels to slow inflation and push the country into two recessions in the early 1980s.

Jerome Powell and his company don’t seem too keen to keep this going for a full decade.

Of course, we could be in a recession, and the stock market is sure to fall further. But if the Fed can control inflation, doesn’t that seem like good news at some point?

2. Why is the market always so easy in hindsight? Well, that’s both rhetorical and obvious, but it’s also what drives the market crazy.

You can tell me that inflation will hit 3% a year from now and the stock market will be back at all-time highs again.

Or inflation remains stubbornly high at 5-6% and the market continues to struggle.

What if supply chain disruptions persist or commodity prices continue to rise? What if the Fed can’t stop some form of wage price spiral?

Maybe the Fed has sent us into a deep recession, or maybe a soft landing.

Whatever happens, it will be obvious in the rearview mirror, but it’s hard to say what the most likely outcome is right now.

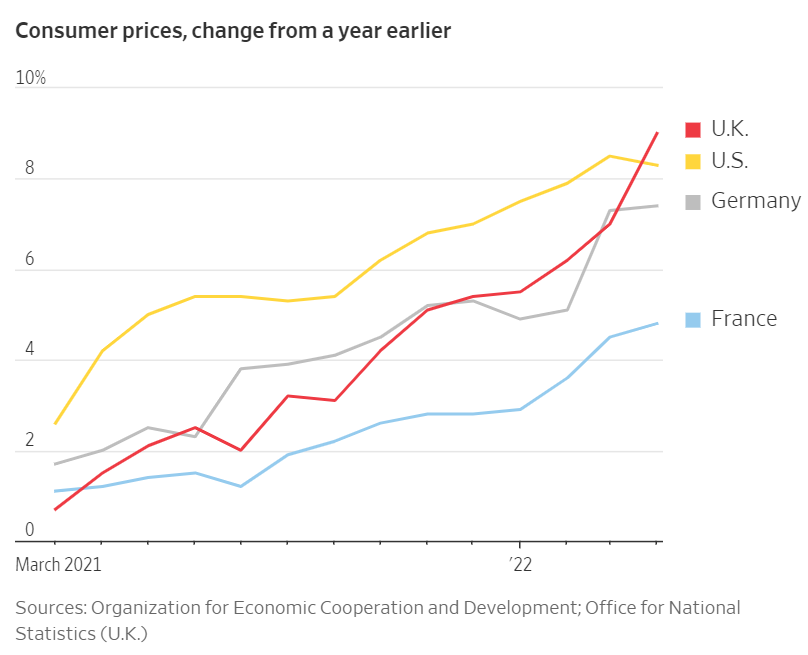

3. Is the Fed really responsible for all this inflation? England has just report Inflation was the highest in 40 years at 9%.

Prices are also rising in places like France and Germany:

I understand all the hatred against the Fed. They had their feet on the gas for too long, and now they were going the other way, slamming the brakes. There’s no reason to keep buying mortgage bonds while the housing market is going through its biggest boom ever.

But you can’t blame the Fed entirely for higher prices.

The pandemic has apparently caused problems in other countries as well. Supply chain has always been an issue. The same goes for labor shortages. Governments around the world spend trillions of dollars. Consumers are bored, so we start shopping.

Now is war.

If the Fed is not the main cause of inflation, can they be the main solution?

I think we’ll find out over the next few months how high interest rates are needed to bring supply and demand back into line.

4. How will rapidly rising mortgage rates affect house prices? Historically, house prices have held up well When Mortgage Rates Rise.

But this pace of rate hikes, combined with the price hikes of the past two years, has us in uncharted territory.

Bill McBride Three possible scenarios are listed this week:

(1) Slow: Single-digit price growth.

(2) Booth: Prices go nowhere.

(3) Depression: Prices fall by 5-10%.

“The data seem to support a scenario of slow house price growth, but I think the most likely scenario is that house prices will stagnate in name and fall in reality,” McBride said.

I know a lot of first-time homebuyers want to see a bust, but even stagnant prices make the housing market much healthier than it has been for the past 18 months or so.

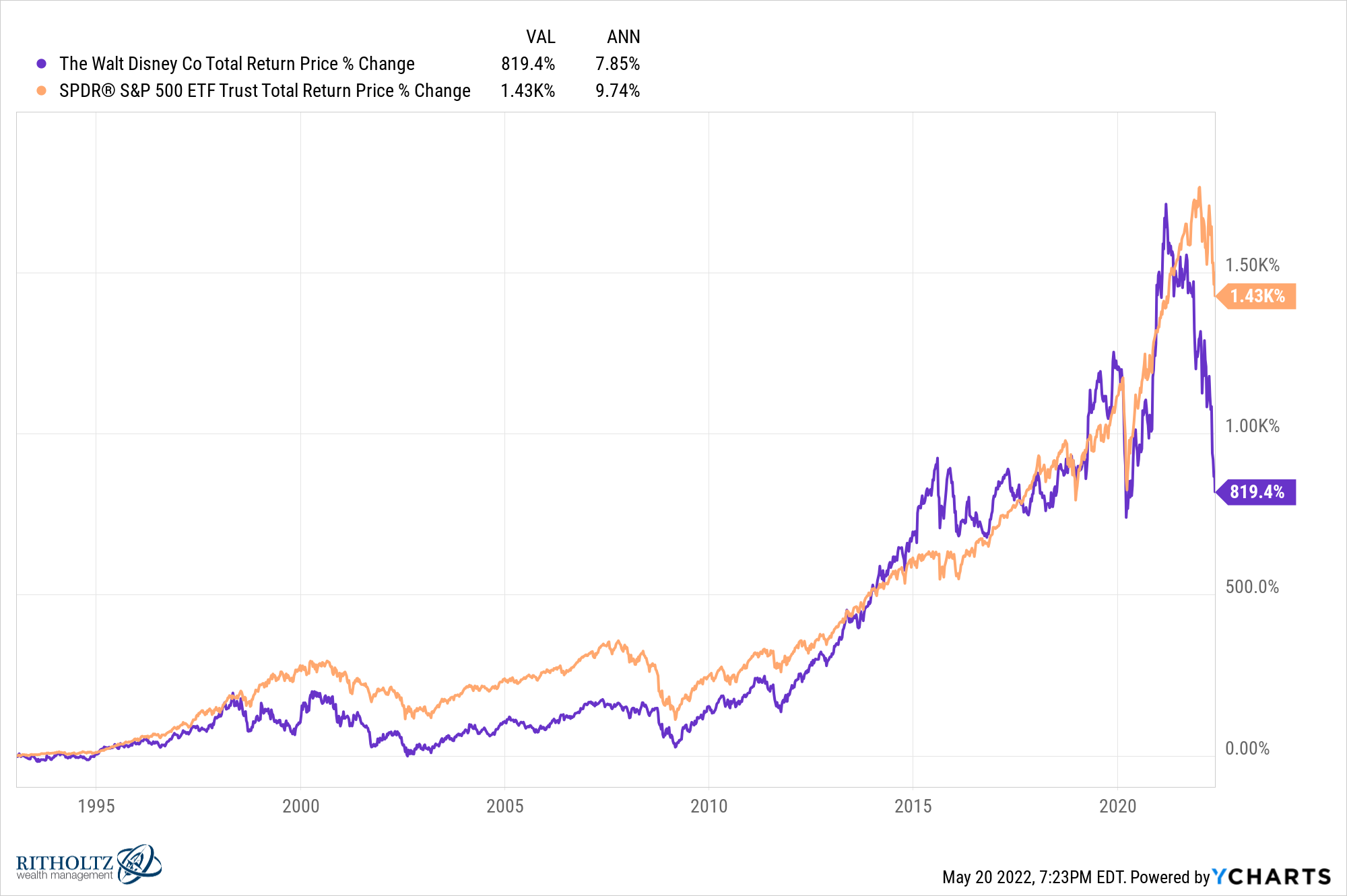

5. Is Disney the poster child for difficult stock picking? Disney owns some of the most recognizable brands on the planet.

My kids have watched every animated movie dozens of times. These songs stuck in my head for weeks on end.

They acquired Pixar in 2006. Then they bought Star Wars in 2012. They also acquired the only cinematic universe in 2009 that no longer seemed to make money by buying Marvel.

of The 20 highest grossing movies of all timeDisney owns 12 of those properties.

Michael Eisner and Bob Iger All visionary CEOs.

I’ve taken my kids to Disney World twice – it’s one of the most amazing, crowded, and expensive places on earth and people can’t wait to go there year after year.

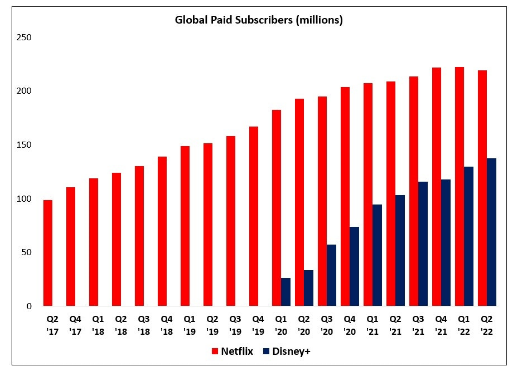

Check out how fast Disney+ is growing in subscribers:

Yet… Disney has traded below the S&P 500 since the inception of the SPY ETF in 1993:

Obviously, a lot of this underperformance has happened in the past year or so. The pandemic hasn’t helped the theme park business, and Netflix’s recent struggles have left the entire streaming complex in limbo.

But over those three decades, one of the world’s biggest brands has underperformed the stock market.

Investing is hard.

6. Is A Quiet Place Part II one of the best sequels ever made? I liked the original and watched the sequel when needed. It’s on Amazon Prime right now, so I decided to rewatch it.

It holds up.

I’m a sucker for alien movies. The first 10 minutes of this movie are probably one of the best intros to aliens I’ve ever seen.

Here’s my list of the best sequels of all time (in no particular order): The Godfather Part II, Austin Powers: The Spy Who Slept With Me, Back to the Future Part II, Terminator 2: Judgment Day, The Dark Knight, and Before Sunset.

I’m not a huge Star Wars fan, but I think you can convince me to join The Empire Strikes Back too.

7. How far will this bear market go? I wish I knew.

Some want to see more surrenders.others think everyone It’s all borne now. Some believe a recession is a foregone conclusion. Others think we can delay the slowdown for a few more years.

The problem with trying to bottom during a bear market is that you can throw fundamental and sentiment indicators out the window.

In the short term, sentiment is more important than fundamentals, and sentiment readings are harder to interpret than ever because anyone who wants a platform these days has a platform to share their views on.

The stock market route may stop. It can cause the most pain and cause us less stress. Or it could trap investors in a volatile range for months on end.

Saying “I don’t know” is uncomfortable, but sometimes when it comes to investing, it’s the safest place to be.

Michael and I talk about bear markets, Disney, the Fed, inflation and everything in this week’s Animal Spirits video:

subscription compound So you never miss an episode.

Further reading:

Every time I go out is a guess

Now this is what I’ve been reading lately: