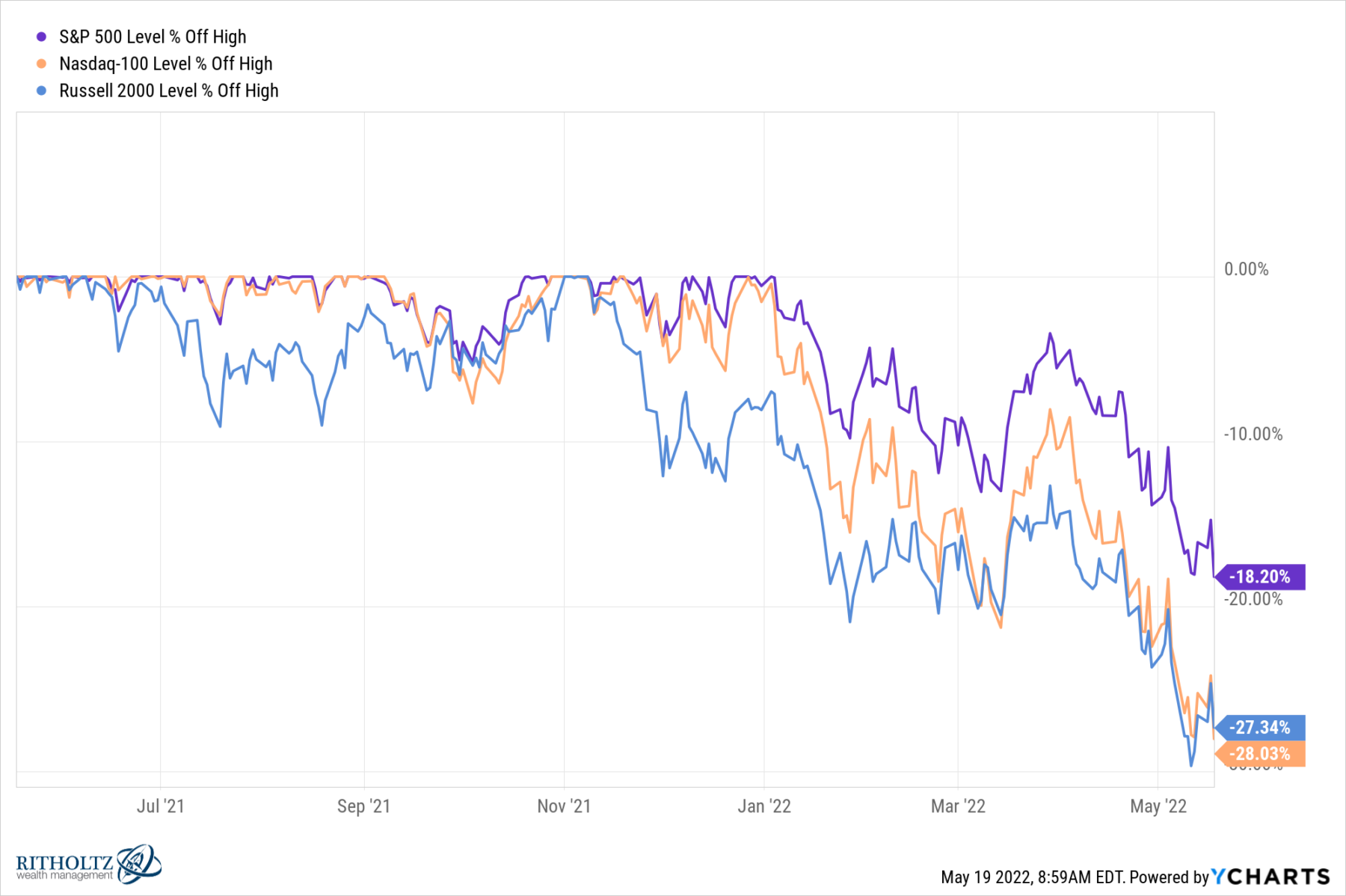

Yesterday’s market carnage brought the S&P 500 down more than 18% from its highs; the Nasdaq is now down more than 27% from its peak, and the Russell 2000 is down more than 28%.

It’s never too early to start preparing for anything surrender happens and market low Finally done, whether they happened yesterday or six months from now.

Over the years, I’ve had some luck — and some disaster — buying into the chaos. Here are some ideas that have worked for me over the past few decades. As you start making a wish list and start thinking about how to use this drawdown opportunistically, consider whether these will work for you:

1. start humbly: We never know how far these retracements will go or how long they will last. Is this a small 20% pullback? 30% crash? worse? (we do not know). The 34% crash in 2020 lasted just one month, the 2008-09 global financial crisis lasted 18 months, and the 1966-1982 bear market lasted 16 years.

Start your plan by acknowledging that you are venturing into uncharted territory. Never bet on a farm or take such a big risk, if the underlying premise turns out to be early (aka “wrong”), the entire portfolio could be destroyed.

2. seek asymmetry: Look for opportunities where the upside is far greater than the potential downside. Traders never know which of their positions will succeed or not advance. The potential to generate net gain is valuable, even if you only hit $0.300.

3. automation: Well-meaning bottom buyers often fail to execute trades (despite their own desires) out of fear and emotion. Take your edge systems out of the process by deciding on a series of items and then automating them.

4. buy over time: Instead of guessing at a specific “ideal” entry date, consider spreading out your purchases over several months. Use your large discretionary trading capital to choose six dates in the next year. That guarantees you both sooner and later — but it’s also likely to keep your average purchase price well below what it will be six months after the market recovers.

5. buy across price levels: Another way to avoid guessing the bottom is to make multiple buys at different price levels: Example: Set a GTC limit buy order to buy a broad index down 19%, 26%, 33%, 42%, or even 53%. (I like to avoid integers). If only half of your orders are filled, it means the market has avoided some of the worst downturns in the past 50 years – but you are still a good buyer.

6. favorite stock: While I like broad indices, some people have their favorite companies. Consider the ones that may have moved away from you in the last cycle that you wanted to have long-term. Whether it’s Nvidia, Apple, or your personal favorite, follow the same strategy of making multiple purchases at different price levels.

7. Use options sparingly: We keep hearing anecdotes about Robin Hood/Reddit traders who used options with great success in 2021, only to see terrible results in 2022. Professionals use options to manage their risk — basically identifying their losses ahead of time.

example: Instead of buying a $100,000 stop 10% position, they bought a $10,000 long-term call option. Time decay makes the risk parameters vary widely between stocks and options, but can be a useful strategy if used properly.

8. It’s hard to be short: To get the right short trade, you must first identify a clear direction lower; second, time it well, and finally, borrow the stock. All of this is harder than it sounds: Shorts can get squeezed, borrowed shares can be recouped, costs can accrue, and timing can be very difficult.

9. avoid leverage: Speculative market crash buying with borrowed money is a recipe for disaster. Do not do!as Gerard Loeb Written in 1935, this is not just a gain, it’s a battle for the survival of an investment.

10. Be patient + stick to your plan: Buying corrections, bear markets or crashes is a challenge that few can do well. It takes planning, patience, and a lot of time to unfold.

These 10 ideas have served me well over time; your list might include 10 completely different approaches. But no matter what approach you take to correct or crash, careful consideration and planning are the best recipes for success, regardless of the specific ingredients.