Now, a glance at the stock index might be enough to keep you up at night.this S&P 500 Index Wednesday posted its worst performance in two years.while the S&P 500 Dow Jones Industrial Averageand Nasdaq They fell 3.05%, 2.9% and 3.82% for the week, respectively.

It’s perfectly normal to be a little nervous at times like this. But before you consider selling your worst-performing stock or vow never to buy another stock — and so on. There are actually five good reasons why today’s market turmoil shouldn’t shake you.

Image credit: Getty Images.

1. Today’s losses are driven by temporary external factors

One of the biggest concerns for investors today is high inflation — the idea that raising interest rates to quell inflation could lead to a recession. Rising inflation is proving especially difficult for retailers these days.big names such as Target (TGT 1.26%), Amazonand walmart are fighting higher prices. In many cases, there is only so much they are willing to pass on to consumers.For example, in this week’s earnings report, “Our teams are working tirelessly to maintain prices even as we face multiple cost pressures,” Target said.

Shares of these companies have fallen as rising inflation weighs on earnings. The broader environment of inflation and interest rate concerns dragged down the broader market.

But this is good news. High inflation and economic distress are temporary problems. They are external. This is what the company is dealing with right now. But these problems won’t last forever. And, as external factors, they do not reflect weaknesses in a company’s business. Which brings me to the next point…

2. Some of the biggest losers still have strong businesses

As mentioned above, businesses are now facing higher costs. Companies in certain industries, such as consumer goods, were also affected as shoppers spent less. Consumers are also feeling the effects of inflation.

These factors are painful in the short term. But here’s a positive reason: They won’t change the long-term prospects of some businesses. I’ll use Target again as an example. Today, Target shoppers are buying essentials rather than higher-margin items like clothing. But the point is they’re still shopping at Target.

In medical devices, Stryker Inflationary pressures from raw material shortages are expected to persist throughout the year. But on the fourth-quarter earnings call, Stryker said: “We believe the underlying demand for our products remains strong.”

Companies with strong infrastructure, cash levels that can weather tough times, and customers who will buy their products in the future will eventually recover.

3. Today’s dip creates a buying opportunity

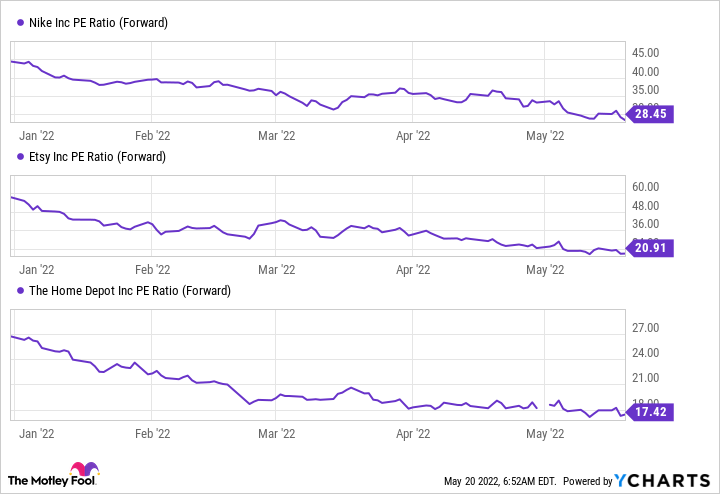

Shares of many powerful companies have fallen in recent weeks. These include companies with declining earnings and those that continue to deliver strong growth. That means their prices relative to forward earnings forecasts have also fallen. This is especially true in the consumer goods sector.Examples include nike, ebayand The Home Depot.

NKE PE ratio (forward) data by YCharts

This equals a buying opportunity. A company with a strong earnings track record and bright future prospects could win in the long run. For those struggling with inflation, earnings and stock prices should recover once today’s external problems subside. That means now is the time to buy these types of players. The idea is to buy and hold for at least five years to benefit from a rebound and additional growth.

4. You don’t lose if you don’t sell

If you research your portfolio today, you might be a little worried. You can even say, “Oh no! I lost X% of my investment.” But always remember: if you didn’t sell, you didn’t lose.

A down market is the worst time to sell. During these difficult times, it’s critical to stay calm, think about why you’re investing in specific stocks in your portfolio, and remind yourself that those elements may not have changed. If a company is a market leader or has strong relationships with customers, today’s external pressures won’t change that. Right now, your best bet is to stick with companies you believe in.

5. The stock market always recovers

It’s important to remember that you probably won’t win with every stock in your portfolio. This is true whether the market is surging or plunging. Investing always involves a certain amount of risk. That’s why it’s a good idea to diversify across industries — and over time, build your portfolio to include at least 25 different stocks. This reduces your reliance on a small number of players – and therefore, reduces risk.

Overall, investing in strong companies that have proven themselves will generally be successful over time. As bad as things look today, the market already knows something worse: a market crash.it is from those collapse in historySo, history tells us that this bumpy period will subside and the stock market will eventually recover — and climb.