Investors, already grappling with falling stock markets and fears that the U.S. economy may be headed for a recession, are now turning their attention to consumers. On the one hand, consumer discretionary stocks were among the hardest hit.

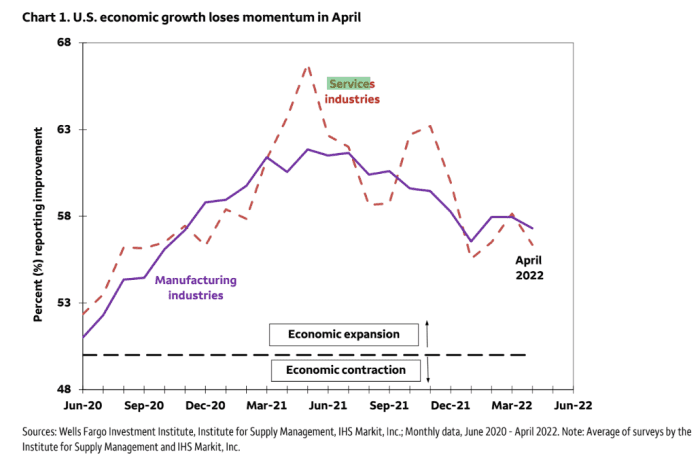

Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, said the market’s focus on peak inflation and how many times the Fed might raise rates is giving way to recession fears.

Christopher said in a phone interview that the shift came in the past week as stocks fell on investor concerns about trends in consumer spending.

“The market is finally starting to price in an actual recession,” he said.

Right now, consumer sentiment is proving as difficult to pinpoint as market entry and exit.

The downturn is “very unbearable,” JJ Kinahan, chief market strategist at online brokerage Tastytrade Inc., said in a phone interview. “It’s like going into a boxing ring day in and day out and getting your ass kicked, but you haven’t been knocked out. So you have to go back and re-box.”

Stocks have yet to make a “big low” and with the market vulnerable to bear market rallies, sell any “tear”, In a May 19 report, advised investment strategists at Bank of America Global Research.

On Friday, the S&P 500 SPX,

The trade entered bear market territory but avoided a close there as it narrowly rose on a mixed close in U.S. stocks. Still, the S&P 500 and other major benchmarks were down for another week, with the Dow Jones Industrial Average, Dow Jones Industrial Average,

Bookings fell for the eighth straight week Longest losing streak since April 1932.

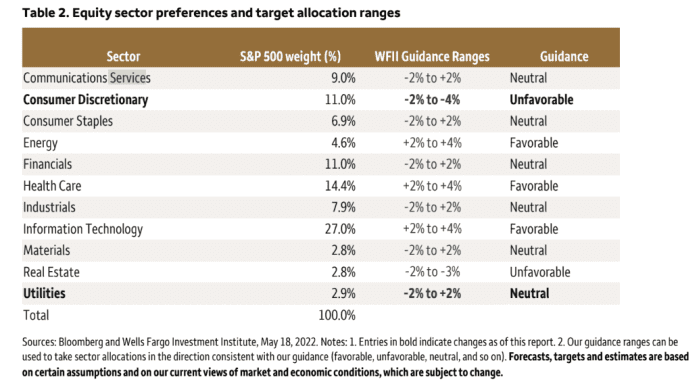

Wells Fargo Investment Institute said in a May 18 report that it was adjusting its stock guidance and price target for a “likely” recession, raising the utilities sector to “neutral” from “most unfavorable.” Utilities are considered defensive, unlike the consumer discretionary sector, which Wells Fargo downgraded to “unfavorable” from “neutral,” the report said.

Consumer Discretionary SP500.25,

The worst-performing sector in the S&P 500 closed lower on Friday, marking its seventh straight weekly loss and its longest losing streak since July 1996, Dow Jones market data showed.

read: Retail stocks woes hit consumer ETFs as S&P 500 nears bear market territory

Here’s Wells Fargo’s preference for the equity sector in its May 18 report.

Wells Fargo Investment Academy

‘sticky’ inflation

“Inflation is hitting purchasing power,” Christopher said. “It’s so tricky,” he said, “even after the Fed raises rates, it’s going to be with us for a while.”

Walmart Inc. WMT reported no profit in earnings results,

and target company TGT,

The past week has sparked investor concerns that high inflation is dampening consumer spending while eroding corporate profit margins. Shares of Walmart have plunged more than 19% in the past week, while shares of Target have tumbled about 29%.

read: Walmart says consumers are relegating items like dairy and bacon to private label

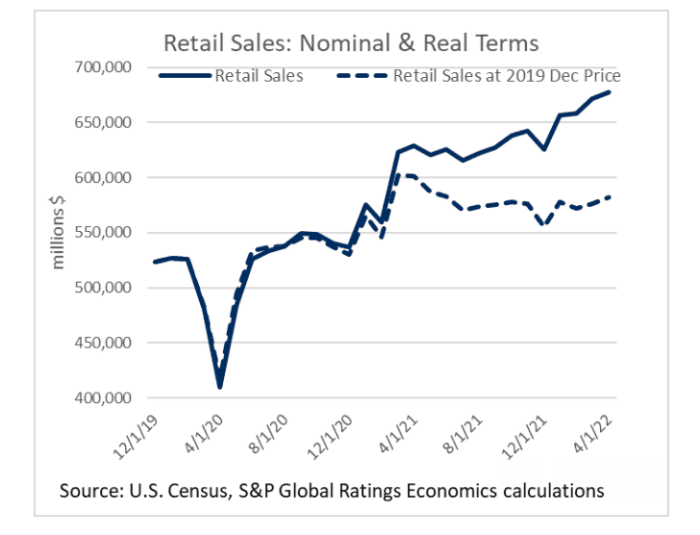

“Unfortunately, gasoline prices rebounded to another record high in May,” Beth Ann Bovino, chief U.S. economist at S&P Global Ratings, said in an emailed comment in May. , and with rampant inflation across most categories, people are spending more on fewer goods.” 17.

When Standard & Poor’s adjusts US retail sales in April As for inflation, “there was a terrible split last year, and it didn’t get wider until April,” Bovino said.

S&P Global

“Purchasing power is squeezed, especially for low-income households,” she said. “While saving savings during the pandemic provides households with a buffer against these higher prices, eventually those buffers will thin.”

Although the labor market remains strong, new U.S. jobless claims climbed to Highest point in four months. Christopher said the Wells Fargo Investment Institute believes a “moderate recession” could begin later this year.

They are not alone.

“We continue to expect Fed policy-induced tightening in financial conditions to be likely,” Deutsche Bank analysts led by U.S. chief economist Matthew Luzzetti wrote in a May 20 research note. would lead to a recession by the end of 2023.” For weeks, U.S. financial conditions have tightened sharply. “

Wells Fargo Investment Academy

Next week, investors will get new economic data on inflation, consumer spending and disposable income.this US Economic Calendar Also included are consumer confidence, U.S. manufacturing and services, initial jobless claims, and FOMC minutes. last policy meeting.

nervous investor

According to Tastytrade’s Kinahan, while investors are nervous, stock market bottoms tend to form after “panic selling” and the recent plunge so far has been “orderly”.

The S&P 500 has fallen about 18% this year through Friday, the Dow is down 14% and the tech-heavy Nasdaq Composite is down about 27%, according to FactSet.

read: The S&P 500 narrowly avoided a bear market. How long will they last after they arrive?

From a bullish investor’s perspective, a bear market requires “savage, horrific, dystopian price action,” Bank of America investment strategists wrote in their report. “Tape has shown massive damage,” and the “inflation shock” is largely priced in, along with the “interest rate shock.”

Citing a bullish view, the strategists wrote that once the “recession shock” is discounted, “lows will be made.”

Both Kinahan and Wells Fargo’s Christopher cautioned against trying to time the market, with Kinahan describing any attempts to bottom out as “a fool’s errand.”

With the market hitting new lows, investors may consider putting in a little cash and buying quality stocks to minimize losses, Christopher said. “If you’re a long-term investor, you don’t want to take your money out of the market,” he said.

Wells Fargo Investment Research has cut its year-end target price range for the S&P 500 to 4,200-4,400 from 4,500-4,700, the report showed. That was above the index’s close of 3,901 on Friday.