In the past two years, the real estate market has continued to heat up, and housing bidding wars have pushed up prices.Some potential buyers are institutional buyers, or companies buying properties to rent or renovate sell these.

The National Association of Realtors delves into the impact of institutional buyers on home sales and single-family rentals. The study estimated institutional buyers’ market share of home sales using Black Knight’s real estate deed records (BKI) and compares the median price of institutional buyers to the median price of all buyers.

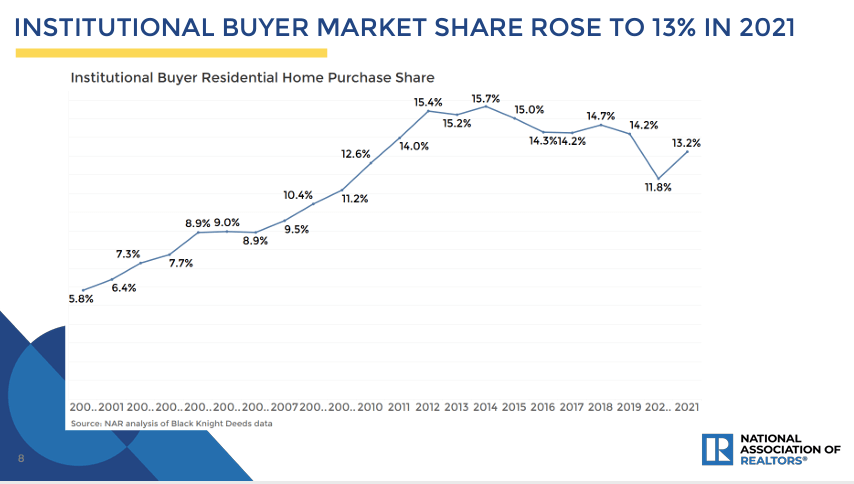

Institutional buyers make up 13.2% of the residential sales market in 2021, and the median purchase price for institutional buyers is typically 26% lower than the state median purchase price, NAR said. Market share rose from 11.8% in 2020, but was still lower than 15.7% in 2014. As shown below.

The rise of single-family homes built specifically for the rental market has increased rental housing stock as institutional investors buying existing homes take homeowners’ available stock with them, the study said. The NAR estimates that by 2021, single-family construction of rental housing starts will rise to 5.2%. The rental build market share increased by 5.6% in the South, 4.5% in the West, and declined in the Northeast and Midwest.

Institutional buyers tend to buy in markets with strong family formation, strong housing and rental markets, high-income markets, and high density of minority groups, especially black families.

Institutional buyers tend to buy in markets with strong family formation, strong housing and rental markets, high-income markets, and high density of minority groups, especially black families.

“Renters make up an average of 30 per cent of households in areas with a high percentage of institutional investors, compared to 27 per cent in areas with a low percentage of institutional investors. This means that while buy-to-rent institutions Buyers are offering rental housing, which creates inventory for future homeowners,” the study said.

Institutional buyers account for 15 percent of single-family home purchases in 2021, according to a separate NAR survey of real estate agents. The main reason homeowners sell to institutional buyers is that they provide cash. About 42 percent of properties purchased by institutional buyers were converted to single-family rentals and 45 percent were resold. On average, though, institutional buyers are making roughly the same offers as non-institutional buyers.

States with the highest institutional buyer market share are Texas (28%), Georgia (19%), Oklahoma (18%), Alabama (18%), Mississippi (17%) ), Florida (16%), Missouri (16%), North Carolina (16%), Ohio (16%) and Utah (16%).

However, with mortgage rates rising, competition for homes may be cooling. But with that comes a likely increase in demand for rentals. E.g, April Existing Home Sales It fell 0.3% from March to an adjusted annual rate of 5.61 million units, below expectations for 5.65 million units. Unsold existing home inventory increased to 2.2 months of supply in April from 2.0 months in March, but remains well below the typical six-month level.

Stocks in the single-family rental market include Invitation Homes (Ultra high pressure) and American Homes 4 Rent (AMH). Last year, KKR (KKR) are reportedly forming a single-family rental company, My Community Homes and Blackstone (BX) reached an agreement to acquire Home Partners for $6B.

For companies involved in home flipping: Opendoor Technologies (Open) and Offerpad (OPAD). Recall that Zillow (Z) winding up Its iBuying business.

Some home builders have also entered the single-family home rental space. Last year, Lennar (Lun) Founded Upward America Venture Buy single-family homes for rent in high-growth markets.

See why SA contributor DGI Journeyman calls American Homes 4 Rent (AMH) (relative) bargain