If Leo Tolstoy were writing about the state of business today, he might have noticed that happy economies are all alike, but every unhappy economy is unhappy in its own way.

China’s growth prospects hit by strict Covid-19 lockdowns to quell its Omicron outbreak; Fed risks turning US boom into bust; European households enduring cost-of-living crisis; situation in many poorer emerging markets To make matters worse, food crises and even famines are beckoning.

It’s no surprise that sentiment is darkening as the global economy recovers from the pandemic, with each of these four distinct but serious issues plaguing the global economy.

According to Robin Brooks, chief economist at the Institute of International Finance, the confluence of these shocks shows that the world economy is already in trouble. “We’re in the midst of another global recession scare right now, but this time we think it’s real,” he said.

Financial markets were spooked. The MSCI World Equity Index is down more than 1.5% in the past week, down more than 5% in May and more than 18% since its peak in early January. Dhaval Joshi, chief strategist at BCA Research, noted that in addition to a rough time for stocks, bonds, inflation-protected bonds, industrial metals, gold and crypto assets also saw a sell-off.

“The last time there was a ‘sell all’ star camp was in early 1981, when Paul Volcker’s Fed broke the backstop of inflation, turning stagflation into a full-blown recession,” Joshi said.

Defining a global recession is not easy. For individual countries, some economists define a “technical recession” as two consecutive quarters of contraction in gross domestic product. FT prefers more flexible definition Just like the U.S., the National Bureau of Economic Research defines a recession as “a significant decline in economic activity that spreads throughout the economy and persists for more than a few months.”

Globally, definitions have become more difficult.this International Monetary Fund and World Bank Prefer to describe a global recession as a year of declining real incomes for the average citizen of the world. They highlighted 1975, 1982, 1991, 2009 and 2020 as the dates of the first five global recessions.

While official global growth forecasts for 2022 appear to be far from this definition — the IMF in April projected an annual growth rate of 3.6% for this year — the figure is in line with the recovery in the second half of 2021 and the impact on growth in the second half of 2021. 2022 expectations are closely related. Looking at its growth forecast for 2022, the fund has lowered its forecast to 2.5% in April from 4.5% in October last year.

Brooks believes the news since the forecast was published has been so bad that it downgraded its growth forecast for 2022 to just 0.5%, below the expected population growth. “Raising the risk of a global recession is the market’s top priority, and that has an important impact on investor psychology,” Brooks said.

China is the big economy most economists worry about, and fresh data in the past week have added to worries about its outlook.China, which accounts for 19% of the world’s total output, is now so large that when it contracted the coronavirus, the rest of the world couldn’t ignore its pain, not least because it Global Supply Chain and demand for goods and services from other countries.

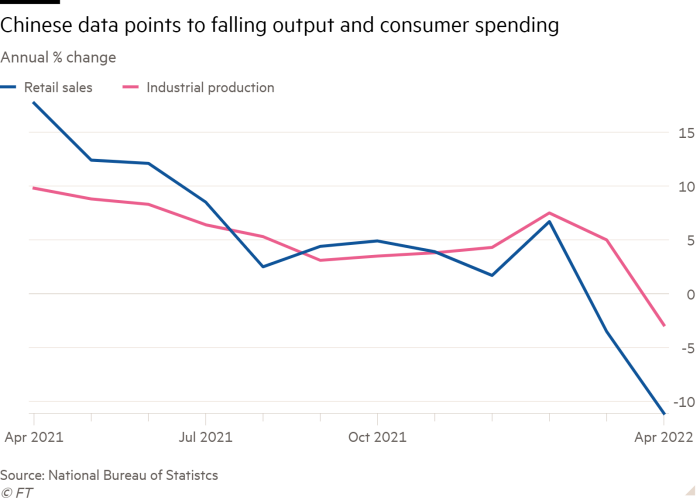

A serious strain has occurred. The country’s manufacturing and retail sectors have already begun to contract as ships line up outside Chinese ports amid a nationwide lockdown.retail sales fall April fell 11% year-on-year, while industrial production fell 3%. Home sales in China also fell more last month than an economic reversal in early 2020, even as the People’s Bank of China eased monetary policy to encourage borrowing and spending. Unemployment is rising.

Kevin Xie, senior Asia economist at Commonwealth Bank of Australia, said China’s economic data for April has been disappointing. He added that while the outlook depends largely on the spread of the coronavirus, “a decline in employment and weakening business and household confidence will dampen spending and be detrimental to the growth outlook”.

In the United States, another global economic powerhouse, the economy is suffering from the effects of the pandemic, particularly excessive fiscal stimulus, which arguably overheated the economy and generated high inflation amid modest increases in energy prices. In addition to a very tight labor market, the Fed has been forced to admit its mistakes and has now decisively entered a phase of tightening monetary policy to slow growth and lower inflation.

Federal Reserve Chairman Jay Powell made clear this week that the central bank will keep raising interest rates until it sees “clear and convincing” evidence that inflation is returning to its 2 percent target. He is not concerned that the unemployment rate will rise “a few ticks” from its current low level of 3.6%.

Powell added that his goal is a soft landing for the economy, but many in financial markets believe that may be difficult to achieve. Evercore ISI vice-chairman Krishna Guha warned that tough rhetoric from officials, economists and market participants will become a self-fulfilling prophecy and trigger a much higher-than-normal risk of a recession.

“To say a soft landing is possible is not to say it is inevitable, or even particularly likely,” Guha said. While he didn’t predict a recession in the U.S., Guha said “controlling inflation without a recession and a big increase in unemployment . . . will be challenging”.

On the other side of the Atlantic, the same difficult problems in Europe are different. With the exception of the UK, inflation almost universally stems from rising energy prices rather than overheating, and can be traced directly to Russia’s invasion of Ukraine.

Unfortunately for the EU, understanding the causes of Europe’s woes does not reduce its consequences. With inflation at 7.4% in April, prices in the euro zone are rising much faster than its citizens’ incomes, taking a toll on living standards that will limit spending and recovery from the pandemic.The new forecast from the European Commission this week is Shrink your hands Sharp and implied stagnation in the second quarter of 2022.

The committee expects the economy to weather this difficult period and return to a reasonable growth rate of about 0.5% per quarter by the summer, but many private-sector economists believe the hit to incomes will have a more lasting impact. Citi economist Christian Schulz said the official forecast seemed overly optimistic, and it was more likely that “there will be little growth for the rest of the year”.

If Europe’s difficulty lies in adapting to much higher energy prices, poorer countries face an even tougher task of coping with rapidly rising food prices, which account for more than 30 percent of spending in emerging economies.

Fears of a food crisis later this year are growing as Ukraine’s Black Sea port for exporting grains closes. United Nations Secretary-General António Guterres said Wednesday that the conflict in Ukraine, combined with existing food price pressures, “threatens tens of millions of people on the brink of food insecurity, followed by malnutrition and mass starvation. and famine”.

Despite its own domestic political and economic crisis, Sri Lanka decided this week foreign debt default first. It said this was necessary to import fuel, food and medicine using its hard currency.

Meanwhile, India reneged on a pledge not to ban food exports this week, exacerbating problems in other emerging economies. Wheat prices are up again, up more than 60 percent this year.

Naturally, with recession risks rising, the best news for the global economy will be Russia’s withdrawal from Ukraine and an end to China’s zero-virus strategy. This is not the gift of economy ministers and officials, so instead they will have to fine-tune their responses to the difficult situations they face again.

In Europe and emerging economies, this will involve mitigating the consequences of higher food and energy prices – boosting welfare and subsidizing food and energy in countries with ample public finances. The U.S. and U.K. may accelerate monetary policy tightening cycles, while China will seek to limit the negative impact of the Omicron coronavirus wave on China.

The majority view among economists is that defenses against a global recession will still prevail in 2022. But in the face of relentlessly bad news, economists are increasingly hedging their bets.

Innes McPhee, chief global economist at Oxford Economics, said there was no doubt that the global economic expansion was nearing its peak and was slowing, and policymakers would need to determine how much tightening was needed. But, he said, a recession is still unlikely because policymakers still have the tools to back off and stimulate if things get worse.

“The risk of a recession goes up into next year, but it’s not that high right now,” McPhee said.