aprott/iStock via Getty Images

With the S&P 500 on the brink of a bear market and the Nasdaq already in a bear market, I believe investors with low to moderate risk tolerance also have the opportunity to capitalize on the sell-off by investing Among low-risk index-focused ETFs. iShares S&P 100 ETF (NYSE:open-end fund) is one of the index funds that can provide long-term growth to a portfolio. OEF’s portfolio includes large-cap growth and value stocks, which helps it mitigate downside risks in volatile market conditions and outperform during bullish trends. Plus, its low expense ratio and dividend factor make it a solid long-term hold for modest portfolios.

How can buying the dip be a good strategy?

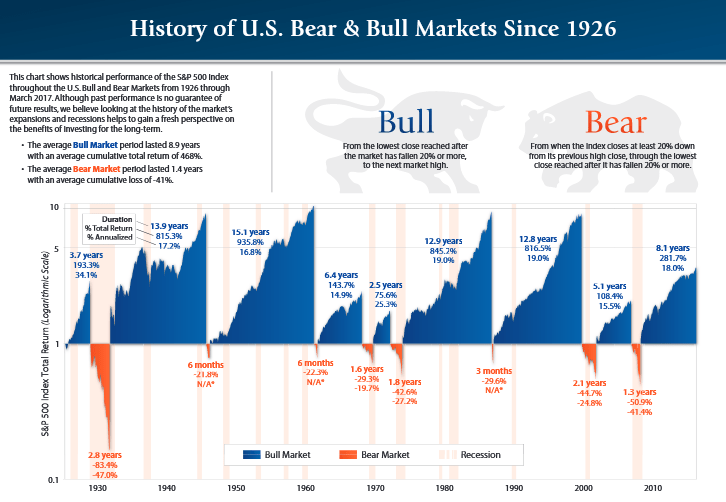

History of American Bull and Bear Markets (raymondjames.com)

The S&P 500 sell-off in 2022 isn’t the first in history. Since 1930, the index has fallen into a bear market about 20 times. After each bear market, the index rebounded strongly, with bull markets lasting an average of 9 years and an average annual return of 466%.

While the market always bounces back strongly after a bear market, it can still be difficult to choose the right entry point and decide if a stock price has bottomed out or how long the downtrend will last. In my opinion, the market has priced in a lot of the impact of interest rate policy and is back to pre-COVID levels after the recent price slump. Large-cap stocks are down about 15% to 25%, while small and mid-cap tech stocks are down nearly 50% to 70% from their previous highs. As a result, valuations have fallen back to their five- and ten-year averages.

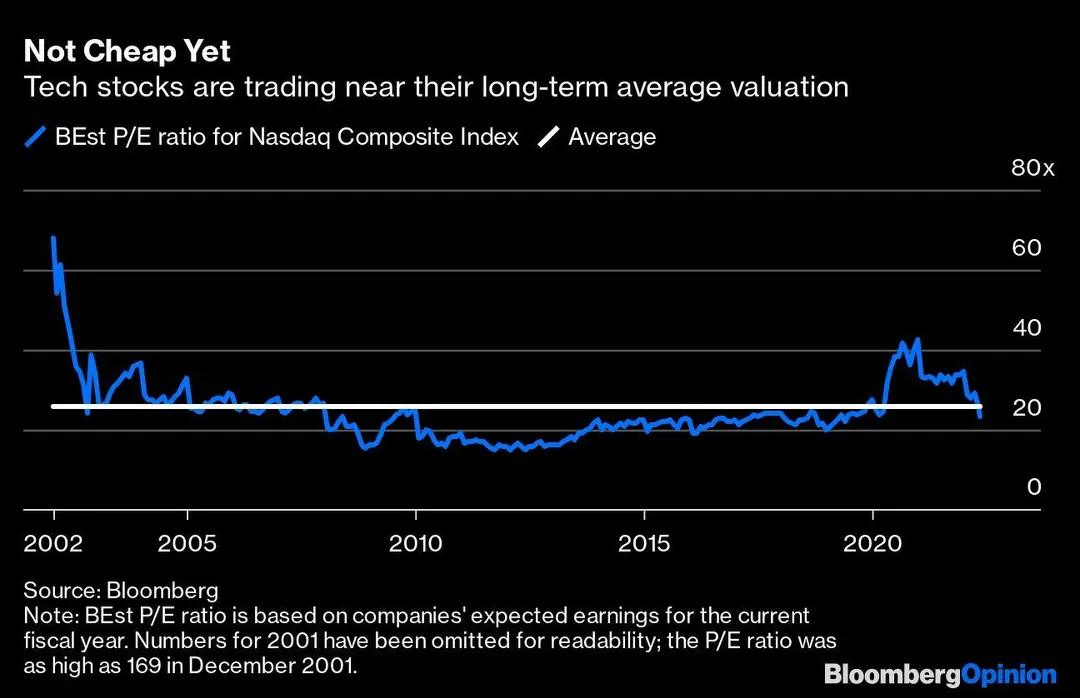

Nasdaq Forward P/E Ratio (Bloomberg)

The Nasdaq’s forward P/E ratio has fallen below 20 from a 2020 peak of 42, according to Bloomberg dataFacebook) looks more like a value stock at 16 times forward earnings. The largest stock market component Apple Inc. (apple) is also in line with its five-year average of 22. The S&P 500 currently trades at 18 times earnings, compared with 33 times earnings at the end of the third quarter of 2021. With stock market indexes now trading near their historical averages, now is a good time to take advantage of the dip and look for buying opportunities. Investors can further reduce the risks associated with single-stock investing by purchasing ETFs such as the iShares S&P 100 ETF for long-term returns.

How does OEF reduce risk and high growth potential?

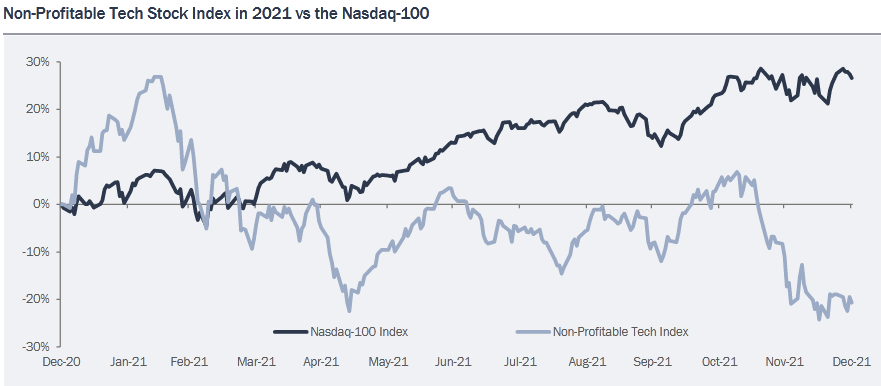

As the fund seeks to track 100 large-cap U.S. stocks, its portfolio includes large-cap growth and value stocks. Recent market trends confirm the view that large-cap stocks are less volatile than mid-cap and small-cap stocks, especially when it comes to tech. The prospect of higher interest rates hits small and mid-sized tech companies that finance their operations with external borrowing even harder. The chart below illustrates the difference in returns for large and small nonprofit tech stocks over the past year.

The return difference between large and nonprofit tech stocks ((VGI partner))

The top 7 stocks in the OEF’s 10 stocks are large-cap growth stocks. Fundamentals for large-cap companies look strong despite near-term uncertainty due to broader market trends and slowing growth data. They are less sensitive to high interest rate policies due to healthy balance sheets.For example, Apple has cash and investments $202.6 billion By the end of 2021, Alphabet ((Google)(Google)) sitting on $169.2 billion in cash and investments. Plenty of cash will allow these tech companies to invest in growth opportunities without relying on high-interest debt. So once the uncertainty subsides and investors regain confidence in the market, these tech stocks could recover more quickly.

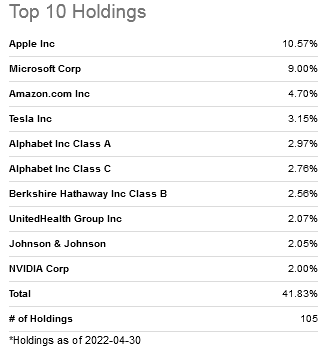

Top 10 OEF holdings (ishares.com)

In addition to large-cap growth stocks, OEF owns nearly 45% of large-cap value stocks. Since the start of 2022, the fund’s investments in healthcare, consumer staples, energy and utilities have helped boost its performance and offset negative tech stocks. For example, its most valuable stocks, such as Berkshire Hathaway’s Class B (BRK.B), UnitedHealth Group Corporation (United Nations University), Johnson & Johnson (Jiangnan), and many other stocks have outperformed the broader market index so far in 2022. In addition to share price performance, most of its value holdings also offer healthy dividends.

OEF vs. Spy and QQQ

The data shows that OEF has outperformed SPY in both price return and total return over the years. With SPDR S&P 500 ETF Trust’s (spy) 64% price return and 79% total return. Since SPY is tracking 500 companies listed on the New York Stock Exchange, including a long list of small and mid-cap stocks, it looks vulnerable to a high interest rate environment. As such, I believe the large-cap-focused OEF will likely outperform the SPY in the quarters and years ahead.

Total Return OEF vs SPY (look for alpha)

on the other hand, Invesco QQQ Trust Series 1 (QQQ) is not worth considering unless you have a high risk tolerance as the fund is designed to track the Nasdaq 100 which is already in a bear market. The QQQ index has plunged 27% so far this year, and the high interest rate environment is likely to increase volatility in portfolios largely concentrated in technology, consumer discretionary and telecom companies. In the case of QQQ, 80% of its holdings are in these high-risk sectors. Also, the fund has a low dividend yield.

final thoughts

With S&P 500 and Nasdaq valuations back to their historical averages, now is a good time to look for buying opportunities. The rate hike policy and inflation concerns have been priced in to a certain extent, and the market is likely to rebound in the coming months. Therefore, OEF seems to be a good option for investors with moderate risk appetite. With a focus on both large-cap growth and value stocks, the fund has high upside potential and low downside risk. Plus, a low expense ratio of 0.20% and a yield of over 1.30% make it a good long-term investment.