Ajay Rajadhyaksha is Barclays’ Global Research Chair. Here, he argues that the market is too worried about a consumer-led recession.

For months, the market has been anxiously awaiting an answer to the question – how are Western consumers doing? After all, in many countries, consumption accounts for more than two-thirds of activity, and consumers have been having a tough time these days.

The answer seems clear.

Food and gas prices skyrocketed after Russia invaded Ukraine. Energy inflation is rampant in Europe; German energy costs rose 35% year-on-year last month. One country after another is curbing food exports as prices skyrocket and food security becomes an existential threat to the regime. (Just last week India bans all wheat exports).

This is a heavy blow for many families. Despite all the talk of labor shortages, wages have not kept pace with inflation. Wages in the US are running between 5-5.5%, while inflation is currently at 8.3%. Europe is further behind. Inflation in Spain is 10%, while wage growth is less than 2.5%.

Things could get worse. Russian gas is still flowing to most of Europe; but that could change. If the planting seasons in Ukraine and Russia are affected, the world will struggle to feed itself in the coming months.

so yes no However A swarm of locusts is on the horizon, but there are other things that could go wrong.

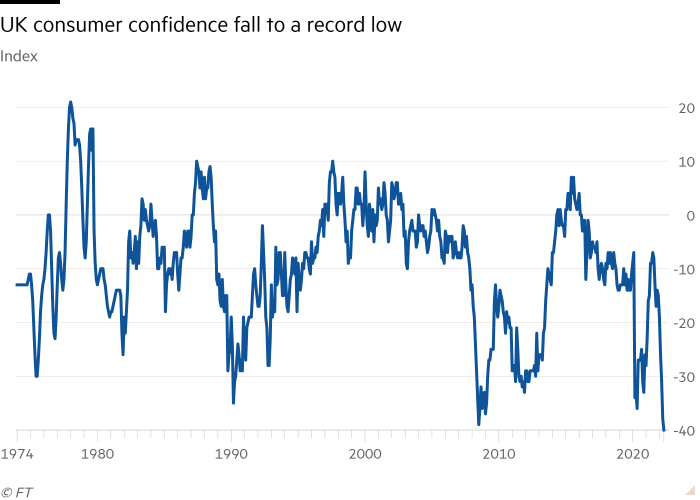

No wonder Western consumers are in a low mood. Survey after survey shows their confidence is at its lowest level in decades.U.S. consumer confidence deteriorates to minimum level Since mid-2011. German consumer confidence It is now lower than in May 2020, when the country was reeling from a prolonged Covid-19 lockdown.In the UK, consumer confidence is currently at lowest level eversince records began in 1974.

Faced with such heartbreaking doom and gloom, it seems only a matter of time before Western consumers turn off the lights, cover up and stop spending. Now it seems that time has come.

Several major U.S. retailers reported first-quarter earnings last week, and the results weren’t great. Walmart and Target cut earnings guidance and complained about weak consumer demand, especially for items with higher profit margins. Sure, there were some management blunders, but investors didn’t take another look: They fled in droves.

Both Walmart and Target had their worst trading days since Black Friday in 1987. These are the moves you usually see in cryptocurrencies, not big boring staple retailers.

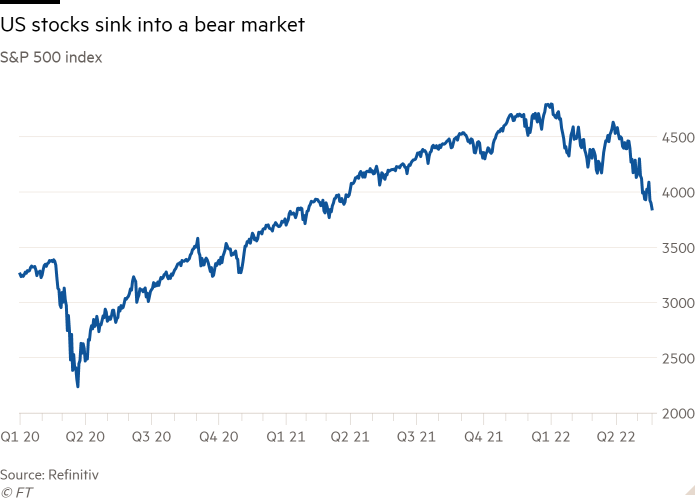

More tellingly, the damage extends beyond these companies. The S&P 500 fell more than 4% and the Nasdaq fell nearly 5%, each having its worst trading day of 2022. To the markets, the results seem to finally confirm what investors have feared since the beginning of the year: Consumers are finally in trouble and a recession may be looming.

Not so fast. It’s a neat theory, all wrapped up in a bow. However, aggregated data does not demonstrate this.

Earlier last week, just as Walmart and Target reported, U.S. retail sales unexpectedly rose, including a strong correction in March. UK retail sales rose 1.4% in April despite a sharp drop in consumer confidence. The April European Purchasing Managers Survey was surprisingly strong.consumers keep Tell We they feel bad, they have good reason to do it, but crucially they are still consuming.

How is this going? Why is consumption holding up despite so many headwinds? Because there is also a tailwind.

First, unemployment in both the US and Europe is at or near record lows. Yes, real wage growth is currently negative, but almost everyone is employed – a huge positive.

Second, Western households have a lot of excess cash — money they didn’t spend on services in 2020 and 2021, which were impacted by the Covid-19 pandemic. The numbers are huge; for example, American households are saving more than the trillions of dollars they would have had if Covid never happened. Even if real incomes take a hit, they appear willing to use these savings to stimulate consumption.

The third is the change in the nature of consumption. Service activity is increasing as we emerge from the pandemic. We’re eating out more and more, taking vacations like never before in 2020 and 2021, and business travel is returning. Sadly, sell-side analysts are again being dispatched around the world (I’m writing this while traveling for work in Asia). Currently, the United States and Europe are setting off a tourism boom.

We’re going to be spending fewer dollars on merchandise this year, especially considering the buying spree most of us continue to do in 2021. This shift away from commodities could disproportionately hurt the companies that make or sell those commodities, which are mostly the big companies we see going public on the stock market.

But that doesn’t mean a pullback for overall consumers. Instead, we spend more at places like local restaurants, community hair salons, and family trips.

This is not an argument for unbridled optimism.One place where consumption is taking a huge hit is China because Zero Covid approach influence activities. Financial markets everywhere are shaking, and central banks are unmoved — not the way to lift consumer sentiment.

But no matter how the stock market seemed to scream last week, a consumer-driven recession in 2022 remains unlikely, at least in the U.S. For now, investors should focus only on what Western consumers do and ignore what they say.