Image source: Getty Images

Health insurance is one of the biggest headaches for any HR department and small business. There are so many uncertainties around what kind of plan to provide, how much it will cost, how to administer the plan, and whether you even are required to provide a plan.

It doesn’t help that the rules and regulations have changed so much in recent years, from the introduction of the Affordable Care Act (ACA) by President Barack Obama in 2010, to attempts to repeal the act by the current administration, to the effect of the upcoming election on health insurance plans.

For small businesses trying to stay on the right side of the law while managing costs and trying to keep employees happy and healthy, this is all a lot to take in. That’s why we have created this guide that covers small business healthcare requirements and touches on the relevant health insurance laws.

1. What do small business owners need to know about health insurance requirements?

Some businesses are required by law to provide health insurance, while some are exempt. We’ll dive into these exemptions below, but there are basic requirements when it comes to providing health insurance to your employees.

Firstly, when you provide a health insurance plan, it must meet the benefit, coverage, and affordability standards set out in the ACA. You also have to offer all eligible employees some form of health insurance within the first 90 days of their employment.

2. Do small businesses have to provide health insurance under the ACA?

Small businesses that have fewer than 50 full-time employees (or the equivalent in part-time workers) do not have to provide health insurance under the ACA, which is sometimes referred to as Obamacare.

Since most small businesses have under 50 employees, this means most are exempt. If you have more than 50 full-time employees, you are required by law to provide health insurance.

The caveat to this is that laws do change, especially as political administrations change, so it’s important to have measures in place to keep up with the latest regulations. This could mean subscribing to industry publications and newsletters, consulting with legal experts, or even reading your HR software vendor’s blogs. The HR software Workday even provides training on dealing with the ACA.

Workday’s free training can help you get up to speed with the ACA. Image source: Author

3. What benefits are there to providing health insurance?

While you are under no legal obligation as a small business to provide health insurance, there are a number of reasons why you should consider it.

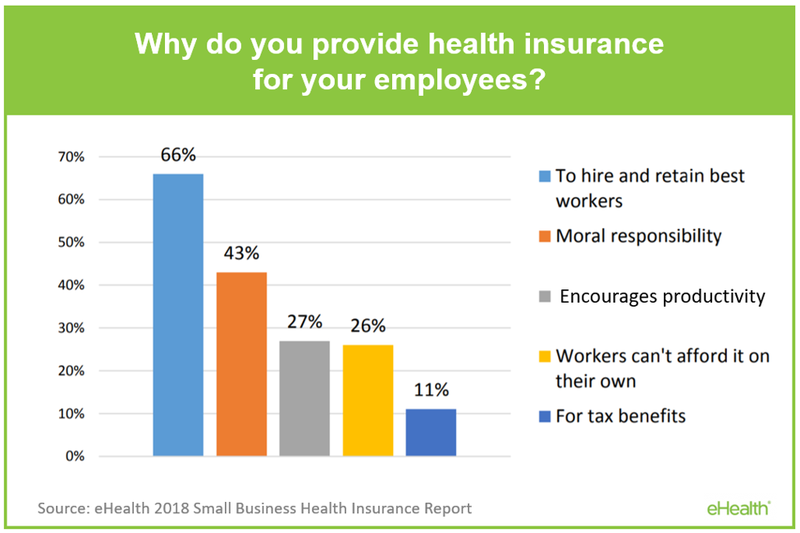

Providing health insurance will help you attract talent, as people prioritize benefits packages when searching for jobs. As a small business, you might not be able to offer the same compensation as large enterprises, but you can make up for that by offering attractive benefits, such as health insurance. In fact, two-thirds of businesses provide health insurance as a way to attract and retain workers.

Businesses often offer health insurance to attract and retain talent. Image source: Author

Also, a healthy workforce is a happy workforce, and prevention is better than needing to find a cure. Providing health insurance shows employees that you care about their well-being, boosting morale, improving satisfaction, and helping retain talent.

You also want to encourage your employees to look after their health — both physical and mental — as illness-related lost productivity costs US businesses about $530 billion per year.

There are also financial benefits to providing health insurance. You can normally deduct your contributions from your taxes, and there are also tax breaks that are offered on a state-by-state basis.

If you use the Small Business Health Options Program (SHOP) Marketplace to buy your health insurance, you may also be eligible for federal tax breaks or tax credits.

4. How can I purchase a health insurance plan?

There is more than one way to purchase a health insurance plan. Here are the most popular for small businesses:

- Group health insurance plans: You can buy these plans through the federally run SHOP Marketplace. This was the most popular choice for small businesses in the past, but due to the high costs and lack of flexibility, this is no longer an option for many companies.

- Qualified small employer health reimbursement arrangement (QSEHRA): Set up by Congress in December 2016, QSEHRA is becoming an increasingly popular choice for small businesses. Under this arrangement, businesses offer employees a tax-free monthly allowance, and employees then choose and pay for their own health care using that money. The advantages of QESHRA are that it gives employees the flexibility to choose their own plan and it’s considerably easier to manage from an administrative point of view.

- Association health plans: Small businesses can join with other small companies to buy large-group health insurance (which is reserved for companies with more than 50 employees). This works in the same way as a normal group health insurance policy.

5. How many employees do you need to qualify for group health insurance?

Group health insurance is a cost-effective way for small businesses to offer health insurance, as it’s cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort (even if it’s only a desk in a coworking space) in the state where you’re applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If you’re a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, you’ll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

6. What is the minimum employer contribution for health insurance?

If you meet the requirements and you opt for a group health insurance plan, you have to pay at least half of the monthly health insurance premiums. You also have to allow employees to cover their dependent children until they are 26, even if they don’t live at home.

However, if you purchase health insurance through the QSEHRA, there are no minimum contribution requirements, and you can decide how much to give each employee each per month.

7. Do small-business employers have to report health insurance on Form W-2?

Under the ACA, employers must report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2. The cost reported should include both the amount paid by the employer and the amount paid by the employee. You don’t have to report dental, vision, liability insurance, and wellness programs on these forms.

While you have to report health insurance costs on this form, that doesn’t mean that this contribution is taxable. Many companies are actually eligible for tax relief from these contributions.

8. Where can I get help to manage my health insurance plan?

Once you’ve chosen a small employer health insurance plan, you still have to administer this plan and ensure that it is cost-effective and meets the necessary requirements. That’s where HR software can help.

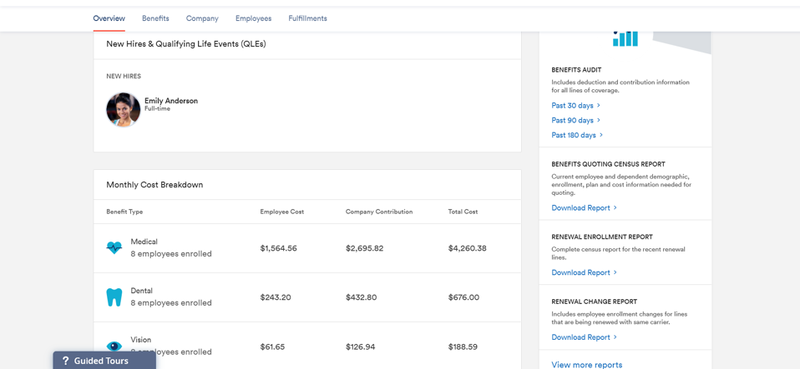

If you choose a solution like Zenefits, you can gain insight into how much your benefits are costing you, plus how many employees are enrolled in your health insurance plan. You can also give employees access to a self-service portal to help them understand more about the plan and easily enroll in it.

Zenefits provides insight into the cost of the benefits you provide employees. Image source: Author

Stay ahead of the game

Providing health insurance to employees can be costly, time-consuming, and complicated, but it can also be beneficial when it comes to attracting and retaining talent, boosting employee morale and satisfaction, and improving productivity levels. You need to weigh the options and decide on a way forward that’s best for your business.

Talk to legal experts, see what your employees think about whether health insurance is a priority, and seek advice from your HR software vendor, as they should have significant experience in benefits administration. And then do what’s best for you to be able to run your business smoothly. It’s an important decision, so don’t rush it.