DNY59/E+ via Getty Images

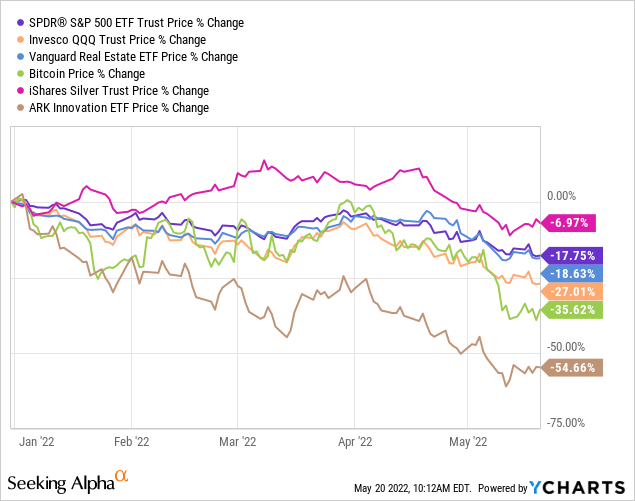

By 2022, almost everything will drop significantly:

S&P 500 (spy)…Technology (QQ)…REITs (VNQ)…Bitcoin (Bitcoin – USD)…even silver (SLV)!

Worst of all, disruptive tech stocks (ARKK) such as those owned by Cathie Wood, lost They have lost a third of their value in the past month alone, having fallen about 50% before that:

REITs outperformed tech stocks, but also fell sharply. Market Cap Weighted REIT ETF (VNQ) slumped 18% despite holding mostly large and well-capitalized REITs. Its largest holdings are in companies such as American Tower (AMT), Crown Castle (CCI), digital real estate (DLR), Pros (PLD) and public storage (PSA).

If such REITs fell 18%, you can imagine that smaller, less creditworthy REITs would have to fall close to 25%, and in some cases even more.

What caused the recent sell-off?

In short, most investors are short-term oriented, and there are a lot of things to worry about in the short-term:

- high inflation;

- interest rates are rising rapidly;

- We are likely to be in a recession;

- Covid-19 still exists and is causing lockdowns in some parts of the world;

- Finally, if that wasn’t enough, Russia, the largest country in the world, decided to invade Ukraine, the second largest country in Europe.

The market has a lot to digest. Suddenly, analysts’ forecasts for the next few quarters have become more difficult, and if you’re short-term oriented, I don’t blame you for worrying.

This has led many members of high yield landlords to ask us:

Is now a good time to buy the dip, or should we exit the market before it falls further?

If you’ve been a member of High Yield Landlords for a while, you probably already know my answer.

I always start by saying that it is impossible to time the market. Various studies have proven time and time again that investors who try to get in and out of the market end up losing far more than they gain in the long run.

That’s because you’ll never know when we’ve bottomed, and you won’t be able to consistently get back into the market on time to reap the benefits of a recovery, which usually happens very quickly.

Here’s a good example for you to ponder: Who would have predicted that the market would hit all-time highs less than six months after the pandemic and one of the worst economic contractions on record?

Hardly anyone, which is why it’s so important to keep a cool head in turbulent times. My favorite quote from Warren Buffett is:

“If you don’t want to own a stock for ten years, don’t even think about owning it for ten minutes. “

He is essentially saying that “time to enter the market” is far more important than “time to grasp the market.” Legendary investor Howard Marks takes the idea a step further, explaining:

“Because we don’t believe in the predictive power needed to properly time the market, we keep our portfolio fully invested as long as we can buy assets that are attractively priced. It’s unpleasant to hold investments that are falling in price, but because we haven’t It is unforgivable to be hired to buy what we want and miss out on the return.”

We share the same philosophy, so unless we think everything is overvalued, we will never get out of the market.

This is clearly not the case today.

In fact, I think the opposite is true. The REIT market was reasonably priced before the recent sell-off, and shares are now another 20-30% cheaper.

This may seem like common sense, but to buy low and sell high, you need to buy low first. Unfortunately, many end up being paralyzed by volatility and never act out of fear that prices might fall even lower.

We’ve made huge profits in recent years because we’ve accepted that we can’t time the market, so instead of trying to bottom out, we’ve continued to buy the dip in multiple stages, adding a small amount each week.

Today, we continue to execute the same strategy because we know it will pay off in the long run. Of course, we don’t have a crystal ball and have no way of knowing how the REIT market will perform in the short-term, but the REITs we’ve picked have a strong chance of delivering solid returns in the long-term for 10 reasons:

————–

Reason #1: They are discounting a lot

We purchase quality, professionally managed real estate below fair value. It’s not exactly rocket science, but it’s a tried and true strategy that will always pay off over time. Will it be different this time? I can’t see any reason.

Reason #2: They Have Inflation-Protected Assets

REITs are inherently good inflation hedges because they have real assets with limited supply but growing demand. Sure, some REITs are a better hedge against inflation than others, but overall, they’re a better hedge than regular stocks or bonds.

Reason 3: Their debts are overstated

REITs are able to fund most of their investments through fixed-rate long-term mortgages. If you’re financing your property with fixed-rate debt, inflation is a gift because your debt will balloon even if your property appreciates in value.

Reason 4: Rising interest rates have not had a major impact on them

Contrary to what you often hear, REITs have performed strongly during periods of rising interest rates in the past. Historically, they have produced an average total return of 17% in the 12 months following a rate hike, nearly double the performance of the S&P 500. REITs do so well during periods of rising interest rates because it usually also leads to higher rents, and because REITs use fixed-rate long-term debt, the negative impact of higher interest rates is limited. That’s especially true today, as the REIT’s balance sheet is the strongest it’s ever been.

Reason #5: Most of them are recession resistant

We could be in a recession, which is never a good thing. However, it’s important to remember that recessions typically don’t last longer than a year or two, and REITs should be valued based on decades of expected cash flow. Therefore, the negative impact of a slightly worse performance in one or two years is not large. Beyond that, most REITs are inherently very resilient to recessions because they generate steady cash flow from long-term leases. The fact that GDP is down a percentage or two isn’t a big deal for most of them. That’s why REITs have historically enjoyed nearly 2x downside protection than the S&P 500 during most recessions.

Reason 6: The end of the pandemic is a powerful catalyst

Many REITs are still discounted because of the pandemic, but eventually, the pandemic will end and these REITs will recover quickly as we get to the other side of this crisis. In many cases, their fundamentals have recovered, but their market sentiment remains negatively impacted.

Reason 7: The Ukraine war is unlikely to affect most REITs

The situation in Ukraine is very unfortunate and cannot be taken lightly. It could have implications for a large number of U.S. companies that do business globally and/or have ties to the energy industry. However, the impact on the REITs we own should be limited.

Reason #8: We Earn Big Dividends While We Wait

Most stocks’ returns over the past few decades have been driven at least in part by P/E multiple expansions, and that may not continue. For this reason, some believe stocks could face a “lost decade” in which stock prices have been volatile or range-bound for years. With REITs, we are less reliant on share price appreciation because we earn cold hard cash every month. As dividend payments become more important, we expect REITs to grow in popularity over the next few years.

Reason 9: They have great opportunities to grow

Today, REITs have their best growth opportunities in years. Rapid rental growth and a wide gap between capitalization rates and development yields allow REITs to earn unusually high returns from developing new properties.

Reason #10: The Ideal Mix of Yield, Growth, Value and Resilience

In the end, it comes down to risk reward. Of course, REITs are not without risk, but in a world of high inflation, low interest rates, and high general uncertainty, I believe REITs offer some of the best risk-rewards. That’s why I feel comfortable allocating most of my net worth to them. If you can earn about 5% and grow at about 5% per year, you can earn double-digit annual returns without even thinking about any multiple expansion, which is not uncommon in the REIT space .

————–

In short, we think there is a lot of opportunity in the REIT space right now. To that end, we will continue to accumulate larger positions. Below, we highlight some of the assets we expect to add to our holdings in the coming weeks:

#1) Outfront Media Inc. (go out): Billboard has suffered huge losses during the pandemic, which forced OUT to drastically reduce its dividend. But so far, business has almost fully recovered, recently leading to a 200% hike in the dividend. OUT’s stock price quickly recovered to near pre-pandemic levels, but with the market’s recent sell-off, OUT gave up most of its gains and returned to trading levels in 2021 when the business performed worse. OUT is selling particularly well as the market fears we may be in a recession, which could lead to companies cutting ad spending. However, we think the desire to be out and about in a post-pandemic world is so strong that companies will continue to prioritize outdoor advertising formats. Even if we’re wrong and business takes a hit in the short term, recessions usually don’t last longer than a year or two, so we think the market is overreacting. Businesses should price based on expected cash flow over decades, with a year or two less significant. As it resumes its previous dividend, OUT will yield over 6% and we expect a 30% upside.

Billboards as an Investment (Outfront Media)

#3) Store Capital Corporation (storage): Our favorite net lease REIT recently posted strong results and raised its full-year 2022 guidance. It now expects its AFFO per share to grow by more than 8%, which is very attractive for a net lease REIT. There’s been a lot of debate about the inability of net lease REITs to hedge against inflation, but as you can see here, it really isn’t true. Priced at a 5.7% yield and growing at this rate, STOR shareholders can expect 12-15% annual returns from defensive blue chips, and as inflationary pressures cool, we expect multiple expansions to gain another 40-50% Upside. We think STOR offers some of the best risk-reward in the entire market (not just REITs), which is why it’s such a great anchor for us.

Triple Net Lease Property Investment (STORE Capital)

Hersha Hospitality Series E Preferred Stock (high temperature polyethylene): The highly leveraged hotel REIT recently announced a major deal that will allow it to pay down a lot of debt and push all maturities to 2024. In addition to this, the performance of its hotels has continued to improve and the company’s profitability is now much greater than it was 6 months ago. As a result, the company’s preferred stock has recently become safer. Still, they failed to recover and were still trading at a 20% discount below face value, making them very opportunistic. You get an 8% dividend yield, and we expect a 25% upside as they get back to face value. Preferred stocks from a low-yield world are very attractive! We are working on a new investment thesis.

Hotels as Investments (Hersha Hospitality)

These are just 3 REITs we expect to accumulate in the coming weeks. But to be completely clear, these aren’t the only opportunities in today’s market. Our core portfolio currently consists of 24 REITs, 12 of which we have a “Strong Buy” rating. This is a great market for new capital to work!