As an immediate return on investment, it’s hard to beat “Untitled,” a 1982 work by African-American street artist Jean-Michel Basquiat who became a global cultural icon on a nearly 5m canvas Featuring an African horn mask on an abstract background wide.

In 2004, the painting sold for $4.5 million. Relisted 12 years later, it sold for $57.3 million, a Basquiat record. This week, it sold to a buyer from Asia in New York for $85 million (£68 million), including fees.

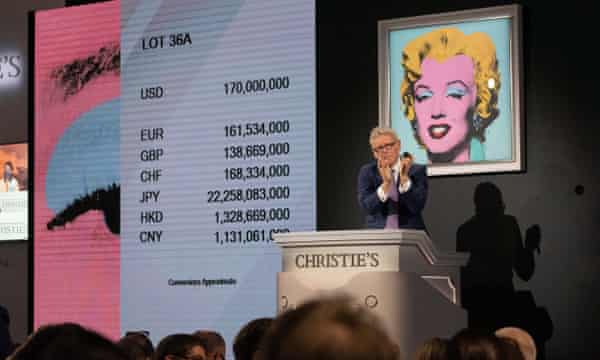

Basquiat’s auction comes amid huge payments for art.Andy Warhol’s sage blue Marilyn – Basquiat’s rival and former friend – sells for A staggering $195 million Earlier this month, three paintings by Pablo Picasso, Claude Monet and Paul Cézanne were awarded Total nearly $166 million Tuesday.

The Macklowe Collection’s second auction this week — a court-ordered auction as part of a bitter divorce settlement between eighty-something Harry and Linda Macklowe — sold for $246 million. The couple’s extraordinary collection, which includes works by Warhol, Jackson Pollock and Mark Rothko, has grossed more than $922 million in sales.

Another stellar collection of 12 works belonging to the late Anne Bass brought in $363 million last week, including Monet’s “Le Parlement, soleil couchant.”

Sales of Impressionist, modern, post-war and contemporary art at major New York auction houses — Sotheby’s, Christie’s and Phillips — raised more than $2 billion this month, According to reports, art market research firm ArtTactic. Sotheby’s New York surpassed $1 billion in sales this week alone, with activity in Asia and online.

At a time of geopolitical uncertainty, soaring inflation and falling stock prices, the art market has outgrown boom. The explosion was driven by a combination of the emergence of an unusual number of very popular titles and an increase in the number of people who could afford to buy them.

“The rich are getting richer,” noted art market expert and author Georgina Adam. Forbes counts more than 700 new billionaires Over the past few years, all over the world. “If you’re super rich, not many of the things you can get are real trophies that no one else can have. Art is the real trophies.”

Anders Petterson, founder of ArtTactic, said there is also an investment element to UHNWI buyouts. “After the financial crisis [in 2008], we see that people want to put their money into tangible assets. We now see one of those elements again. “

Art “is seen as a safe place to put money,” Adam said. “At the high end of the market, the returns can be huge. What other investments can offer such returns?”

Buyer demographics are changing. Nearly a quarter of the total bid price for works in Macklowe’s collection came from Asia. Monet’s Les Arceaux des Roses was sold by Sotheby’s this week to an Asian buyer for $23.3 million. The auction house also saw record levels of engagement from young and new collectors.

“It’s really clear – they’re not just buying cutting-edge contemporary work, they’re buying established work,” said Brooke Rampley, Sotheby’s chairman of global fine art and head of global sales.

The other half of the equation, she said, is supply. “During the pandemic, there are very few works available for sale due to uncertainty about market resilience. Many choose to wait.

“This season, we have seen supply really return to pre-pandemic levels for the first time, and a variety of consignees are choosing to sell great art. This has attracted strong and healthy demand.”

The market has also become more accessible thanks to online auctions. This week, Sotheby’s live-streamed its modern art auction on Instagram for the first time, drawing nearly 20,000 viewers. The auction house, which was forced to go online in March 2020 when the Covid-19 pandemic hit, has embraced digital platforms such as TikTok, Facebook Live and YouTube.

“It opens up a whole new population of people,” Paterson said. The only way to see art auctions in the past was to brave an exclusive, highly privileged and often intimidating group. “Now you can sit in front of a screen at home and watch this play. It’s definitely going to be interesting.”

It remains to be seen whether the current blockbuster sales will continue. “It’s largely driven by the extraordinary art coming into the market,” Lampley said. “If this continues next season, then I would expect it to be in the market. But if this season’s exceptionally rich supply dries up, we may see a different reaction.”

Other factors may play a role, Paterson said. “Confidence in the market is really high, but we have to be careful not to think it’s immune to what’s going on in the rest of the world.

“We are entering a period where people are suffering in terms of the price of food, electricity and gas on the table. There may be difficulties justifying paying those prices.”