Justin Sullivan/Getty Images News

AT&T Inc. (New York Stock Exchange:Ton) continued to soar after it completed its media business spinoff last month, as investors now prepare to value AT&T’s free cash flow at a higher valuation factor.of shares Warner Bros. Discovery (WBD), however, recently hit a new low, suggesting the market has been wrong about AT&T. With AT&T generating billions of dollars in free cash flow, the company’s stock could be an attractive investment during a recession!

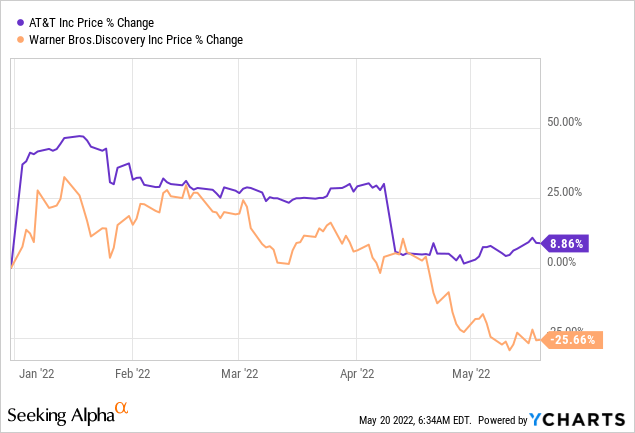

Performance Gap between AT&T and Warner Bros. Discovery

AT&T completed its spin-off and WarnerMedia-Discovery merger on April 8, 2022. After the split, AT&T outperformed Warner Bros. Discovery. While this short-term performance difference is not indicative of future performance, it does indicate that the market is increasingly loving AT&T, in part due to the telco’s large free cash flow, attractive stock yield of 5.5%, and changing investment environment. The content business is not currently highly valued by the market, which may be related to the cloud of upcoming recession.

AT&T Has Great Value During Recession, Stock Yields Attractive

During the recession, AT&T was more valuable to investors than Warner Bros. found. That’s because AT&T generates a lot of free cash flow. Investors value stable and predictable free cash flow during recessions more than during economic expansions. During growth periods, investors are willing to take higher risk, and during recessions, free cash flow becomes even more important to investors.Now, with the U.S. economy likely to edge During a recession, this free cash flow is even heavier for investors who want to take risk out of their portfolios. The dividend yield has dropped to 5.5% thanks to the recent rise in AT&T’s stock price, but AT&T remains an attractive investment for investors looking to buy a company with strong FCF and not always worrying about valuation .

Review Short-Term, Share Buybacks

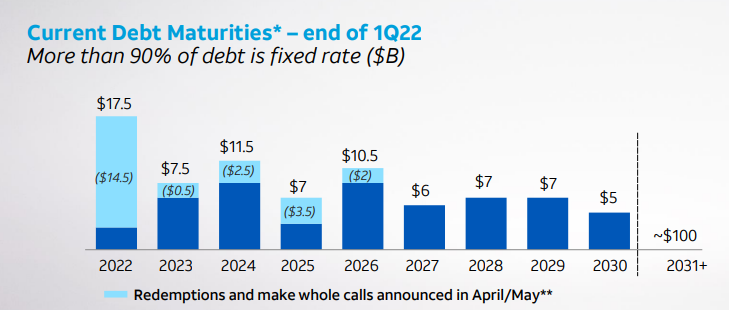

as i said last time Work In telecom, AT&T’s short-term corporate priority will be to pay down its massive debt, which will create a healthier balance sheet in the process. AT&T paid off a $10B bank loan in April and hopes to use most of its future free cash flow to pay down the massive debt it has accumulated over the years. While I don’t think AT&T’s debt is an existential risk, it will take at least a few years for the telecom to stabilize its balance sheet.

AT&T

I expect AT&T to initiate another massive share buyback in fiscal 2024. The company will likely focus on paying down debt for the next two years. However, by fiscal 2024, the balance sheet is likely to be much better, and AT&T may resume large-scale share buybacks. The prospect of share buybacks (or higher dividends) could also help stocks revalue higher.

5G/fiber business gaining momentum

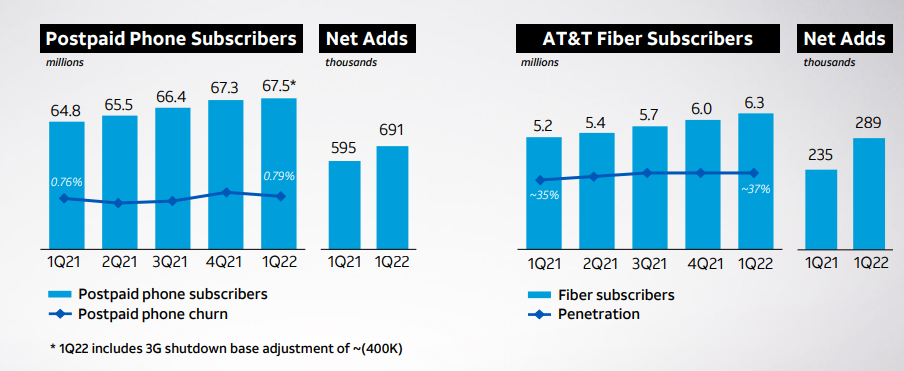

AT&T has a huge opportunity in the growing 5G and fiber market. 5G and fiber were AT&T’s biggest growth drivers, with both areas seeing significant net growth in the first quarter. AT&T fiber business added 289,000 net Q1 ’22, up 23% year-over-year, in part due to increasing penetration. Fiber penetration in the first quarter was 37%, up from 35% a year earlier. Postpaid also saw strong momentum, with a net addition of 691k in 1Q22.

AT&T

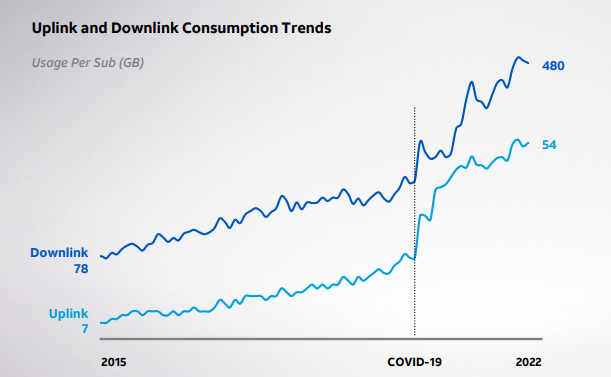

Long-term growth trends support AT&T’s plan to invest $24B in its 5G and fiber capabilities in 2022 and 2023.Widespread acceptance of remote work, the rise of 4K streaming, and the proliferation of connected devices The need for more bandwidth, AT&T can take advantage of this. The pandemic has only accelerated these trends, and demand for bandwidth has been soaring since 2020.

AT&T

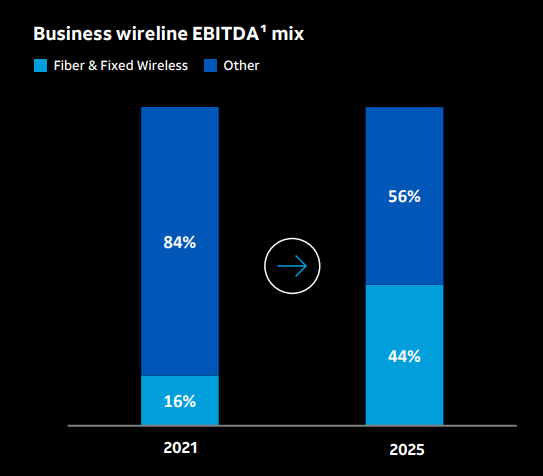

AT&T’s investments in 5G and fiber are expected to result in changes to the revenue mix going forward, with 44% of AT&T’s wired EBITDA expected to come from fiber and fixed wireless services. AT&T’s 5G and fiber opportunities create upside for AT&T’s free cash flow.

AT&T

Inexpensive Free Cash Flow Valuation Factor

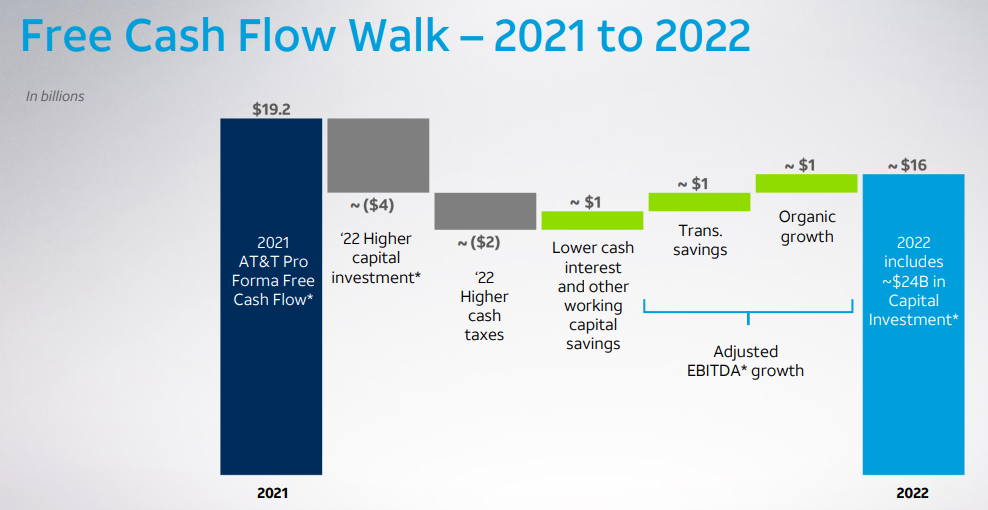

AT&T has said it expects to generate $16B in free cash flow in fiscal 2022, which would be a drop of $3.2B compared to fiscal 2021. The expected year-over-year decrease in FCF is the result of an expected increase in capital investment in 5G and fiber infrastructure. AT&T launched an expense-savings program to help FCF grow, which covers hits from product simplification, network efficiency and overhead. The program aims to save $6B in costs by fiscal 2023.

AT&T

AT&T’s free cash flow is expected to grow to $20B in fiscal 2023. AT&T stock currently trades at a P-FCF ratio of 7.2X based on a projected $20B FCF next year.

AT&T competitor Verizon (VZ) and delivered free cash flow of $19.3B in fiscal 2021. I estimate that Telecom can grow its FCF to $23B in FY22 and $25B in FY23. Based on free cash flow of $25B, Verizon has a fiscal year 2023 P-FCF ratio of 8.2X. From a free cash flow perspective, AT&T is a better deal than Verizon.

AT&T Risk

The recession will likely have a much smaller impact on AT&T than Warner Bros. found. That’s because content consumption falls into the discretionary category, and spending is often cut back during a recession. However, AT&T’s service may see more stable demand patterns during a recession, as customers don’t stop using 5G and fiber service. For this reason, I believe AT&T will provide steady dividend income during a recession. In the short term, the biggest risk to AT&T is its balance sheet. AT&T is committed to reducing debt, and the company should have a stronger balance sheet by the end of fiscal 2023.

final thoughts

The market has been wrong about AT&T, but still underestimates the company’s free cash flow. AT&T stock soared after the separation and significantly outperformed Warner Bros. Discovery stock. I believe this performance difference is due to investors now more willing to buy value stocks that promise high free cash flow and stable dividends as recession risk increases. Going forward, I expect AT&T to continue to outperform AT&T’s former content business and believe the stock is a buy despite the recent gains!