At first glance, the stock market appears to be finally doing well for the week ended May 19 — the benchmark S&P 500 SPX,

It fell just 0.7%. But it was on track for seven straight weekly losses — the first since eight straight weeks in 2002.

In addition, the consumer discretionary sector, which includes most retailers, also took a 7.6% hit. That includes Target’s TGT plummeting 29%,

Walmart TGT,

Doing a little better; its shares fell 19% this week after it reported lower earnings for itself. Both companies are feeling the pinch from bloated inventories.

Here’s Tonya Garcia’s more in-depth coverage of this week’s retail earnings report, including changes in consumer spending patterns:

- Target stocks tumble as changes in consumer spending lead to lower profits and higher shipping rates

- Walmart says consumers are relegating items like dairy and bacon to private label

More on the rough side of retail:

The brighter side of retail

Getty Images

All things considered, the largest home improvement retailer is doing well this week, with shares of Home Depot HD,

Pull back 1% and Lowe’s LOW,

down 2%.

In an interview, Loew CEO Marvin Ellison said People may continue to invest heavily in their homes.

A possible countertrend: Remote work pushes up U.S. home prices during pandemic — so what happens when people go back to the office?

A bear market is getting closer

Joe Redel/Getty Images

The S&P 500 has fallen 18.7% from its Jan. 3 closing high. A 20% drop would be considered a bear market. (Nasdaq Composite COMP,

is already there. ) William Watts shares the history of bear markets and considers how likely the next bear market is to continue.

Mark Herbert studies the psychology of bear markets — The five stages of grief for investors.

Why the stock market has fallen this year

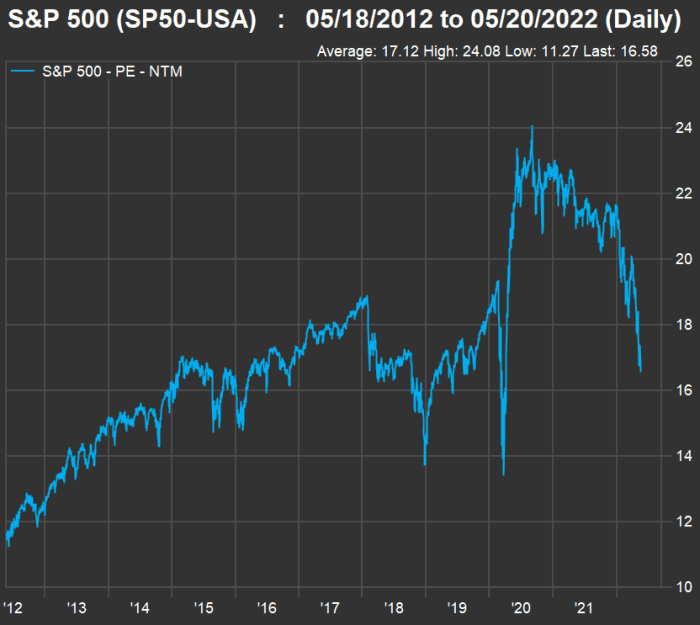

fact set

This chart shows how the weighted forward P/E ratio of the S&P 500 has changed over the past 10 years. With the exception of two brief but sharp declines, the overall trend is up in 2021.

Mark Herbert explained Why the P/E multiple contraction is the real reason stocks have fallen this year.

It’s a lot more fun than worrying about the stock market – where should you live in retirement?

The waterfront in Tacoma, Washington, with Mount Rainier in the background.

Getty Images/iStockphoto

Silvia Ascarelli wrote “where should i retire? ” column, often looking for places off the beaten track to help people with all kinds of needs when considering locations for their golden years. This week she helped a couple who wanted to Find a place they can afford with some culture and access to wilderness areas while avoiding heavy snow.

Try MarketWatch’s Retirement Location Tool for your own custom searches. It includes data for more than 3,000 US counties and contains dozens of your preferences.

Take a Closer Look at Your Retirement Account Fees

Alessandra Malito helped a man who did a lot of work for retirement, but he calculated he was paying $2,164 a year for the privilege.Here’s her advice How to gain a deeper understanding of investment fees.

More retirement plans: The cost of retiree healthcare is climbing — here’s what you should expect to spend

Great idea for housing for seniors

istock

here is A wonderful housing idea that brings families closer together and lowers expenses.

Contrarian investing: Biotech may be nearing the bottom

Back in April 2020, when forward oil prices briefly dipped below zero, it was hard to imagine spending $5 on a gallon of gasoline two years from now. Now Michael Brush points out that 25% of biotech stocks are valued below their cash on paper.here is How close is the industry to a rebound? because of its share price.

More trouble for Elon Musk

MarketWatch Photo Illustration/Getty Images

Tesla TSLA,

CEO Elon Musk continues quarrel Using Twitter’s TWTR,

Board of Directors exceeds How many social media companies may have fake user accounts. This drama could be the basis for Musk Negotiate lower prices Above his initial offer of $54.20 per share for Twitter. Investors didn’t expect the deal to complete in its current form, with Twitter’s shares closing at just $37.29 on May 19.

But if Musk leaves Twitter, his strategy could cost him more than $1 billion in breakup fees.

Tesla’s stock has fallen 28% since April 12, the day before Musk proposed to Twitter’s board to take the company private. On May 19, Wedbush analyst Daniel Ives, who continues to rate Tesla stock as “outperform,” lowered his price target on the stock by 40% to $1,000. Tesla shares closed at $709.42 on May 19.

More coverage on Musk and Tesla:

How a regional bank used the iPhone to go national

Steve Galsey

Steven Gelsi explains how Citizens Financial Group CFG

Has built a national payment network with millions of customers using the iPhone.

Where might Bitcoin go from here?

Terrence Holland, Dow Jones

in this week’s distributed ledger Column, Frances Yue describes the ever-improving trading environment for Bitcoin BTCUSD,

and aggregate the company’s disclosures Losses from Stablecoin Crash.

Time to take some action: Terra debacle intensifies Washington’s focus on cryptocurrency regulations

Want to tax the rich more?plug the loophole

Getty Images/iStockphoto

Some politicians in Washington have been discussing a tax on unrealized capital gains. This can be very complicated and time consuming. Steven M. Rosenthal and Robert McClelland provided A clear, simple plan to tax unrealized investment gains after the super-rich die.

Tax trends favoring the wealthy: The IRS audit rate keeps dropping — especially at 1%

Want more information from MarketWatch?register this and other communicationsand get the latest news, personal finance and investment advice.