Health insurance can be expensive, which leads many people to not have it. In 2020, 28 million people According to the U.S. Census Bureau, there is no health insurance at any time of the year.It is not hard to believe that when health insurance cost The average cost of a family plan keeps climbing Over $22,000 per year in 2021.

expensive and Transparency of healthcare costs appears to be low, it’s no wonder Americans are finding new ways to pay for health care.This guide explains five options for shopping online Medicare Exchangeand how to save on health care costs without giving up the benefits you need.

read more: Best Life Insurance Company

cost-sharing plan

Cost-sharing programs bring people together to share the cost of health care, thereby lowering the cost of payments. With a cost-sharing plan, you pay a monthly or annual membership fee. When you go to the doctor, you pay another fee (such as a copay), and your organization covers the rest of your medical bills. Cost-sharing groups work with doctors and hospitals to negotiate rates, and monthly membership fees often end up being lower than traditional insurance premiums.

Many cost-sharing programs are based on religion or belief and require their members to adhere to certain lifestyle principles. E.g, medical sharing is a Christian cost-sharing organization with a national network that requires members to “have a Christian testimony of a personal relationship with the Lord Jesus Christ.” Sometimes these groups won’t pay for health care related to activities they deem unacceptable, such as treatment for STDs caused by extramarital affairs.

However, if you qualify for membership and happily stick to the kind of lifestyle the cost-sharing organization dictates, the benefits are numerous: Medi-Share Offer 24/7 telemedicine, access more than 900,000 providers nationwide for prescription discounts and additional savings on specific procedures.Other cost-sharing plans include Samaritan Ministry, Sedra Health and Free and healthy sharing.

off-site insurance

You may find more affordable coverage by buying directly from a broker or insurance provider. Over-the-counter insurers try to make it easier for people to find health insurance that suits specific needs and lifestyles, and focus on making the notoriously complicated process less mind-boggling – important because insurance terminology can confuse people when they don’t participate plan needs.

OscarFor example, it’s a tech-based health insurance startup that provides health insurance to individuals, families, and small businesses. The company offers Bronze, Silver, Gold, and Platinum plans that offer the same benefits, but with different deductibles and premium costs—the Bronze plan costs less per month, but you pay more for medical services.

Oscar and most off-site plans offer perks not available with federal plans, such as Oscar’s 24/7 “doctor-on-call” feature and the ability to chat with a registered nurse through the Oscar app when you have a question.Other enticing benefits like Oscar’s tiered cashback partnership Google Fit and apple healthmaking the off-site program more attractive.

If you don’t want to buy insurance on a federal exchange, try an over-the-counter broker or provider.

Getty Images

health pocket, Viva Health and electronic health insurance are other examples of over-the-counter health insurance brokers. Off-site plans are generally eligible under the Affordable Care Act, but be sure to check to make sure before you sign up.

Professional associations and trade groups

By joining a group or organization, you may be able to find a cheaper health insurance plan. E.g, National Association of Self Employers Numerous insurance benefits for small business owners, entrepreneurs, and sole proprietors.

Many trade groups, professional organizations, and alumni associations work in a similar way to cost-sharing plans: you are grouped with other members of the organization, so your costs are pooled and reduced. Search for professional associations related to insurance benefits in your industry – you may be surprised by the plans and rates you find.

You can also check your state insurance department Find group plans that meet ACA requirements.

Professional associations can help you save money by sharing costs with other members.

Getty Images

health discount card

Health discount cards aren’t technically a replacement for insurance: they’re for people who plan to pay cash for health services when costs rise. Also known as a “Medical Services Discount Card”, it can be used for a variety of services at different types of health centers.

You can pay a one-time membership fee for these cards, or pay a small monthly fee, but the discounts can be substantial, sometimes as much as 50%. However, not all health discount cards charge: Welfare card is a free health discount program available nationwide to primary care providers and specialists.

Like traditional insurance plans, health discount cards often have network restrictions, so be sure to check with participating providers near you before signing up for the card – you don’t want to be surprised by a full-price bill.

The Health Discount Card is for people who want to pay cash for services when they need care.

PhotoAlto/Frederic Cirou/Getty Images

telemedicine

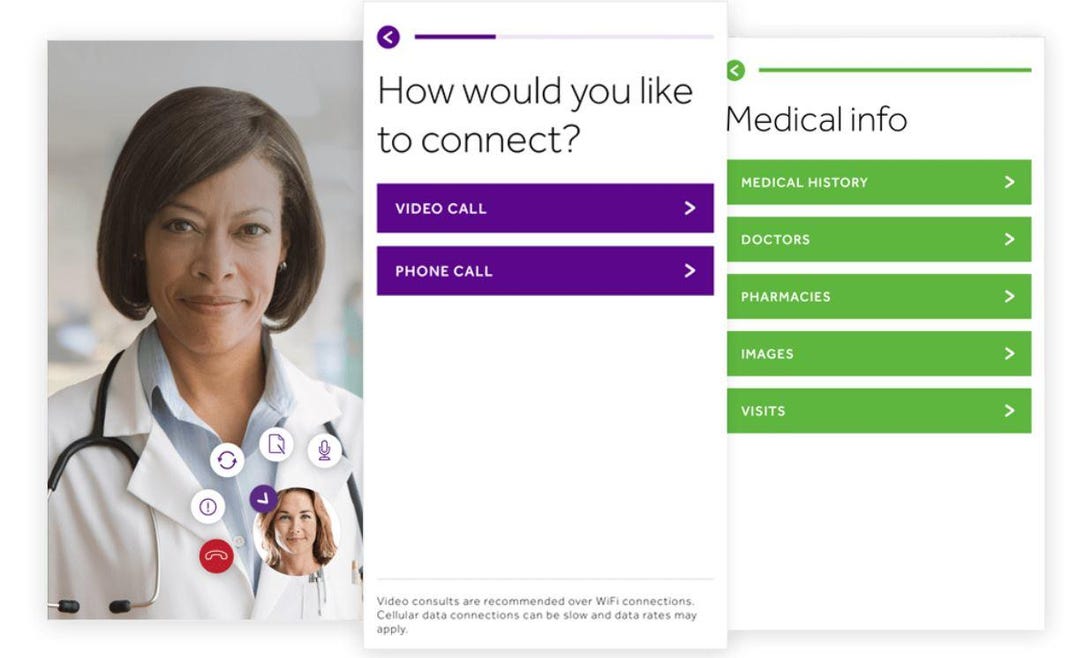

Like a health discount card, telemedicine Not a real replacement for insurance, but it could be the answer to a lot of questions. People without the resources (money, insurance, transportation, or time) to see a doctor in person can use low-cost telehealth services to get a diagnosis and prescription without insurance.

Many telehealth companies do accept insurance if you have insurance, but seeing a virtual doctor is much less expensive than going to a physical clinic without insurance (and sometimes even with insurance). Convenience is another key factor in the telehealth boom.

Of course, telemedicine can’t do everything—many situations require an in-person professional presence—but it can be used as a low-cost alternative for treating easily treatable problems like the common cold and migraines, STD testing and pink eyes.

Most telehealth apps and websites allow you to choose to chat with your doctor via video, phone, or text.

Tradock

takeout

Health insurance is expensive and cumbersome, and many people cannot afford or do not want to enroll in traditional health insurance through the ACA. So, as health care costs continue to climb, people have found a way to take care of themselves without shopping on the Federal Exchange.

The benefits of these insurance alternatives vary and won’t be right for everyone, but they can be a viable solution when traditional health insurance isn’t an option. When you sign up for an alternative, be sure to read the fine print and understand what you get – and what you don’t.